Who We Are

BAFS (Business Alliance Financial Services) provides financial institutions with the best of commercial lending software and services – an industry-first combination.

When was BAFS founded?

BAFS was founded in 2009.

Where is BAFS located?

BAFS is headquartered in Monroe, LA, but provides its commercial lending software and services nationwide.

What does BAFS offer to financial institutions?

BAFS offers commercial lending software and services to financial institutions. Clients have the option to utilize BAFS’ software (BLAST®), services, or a combination of both. What we do is up to you!

What is BLAST®?

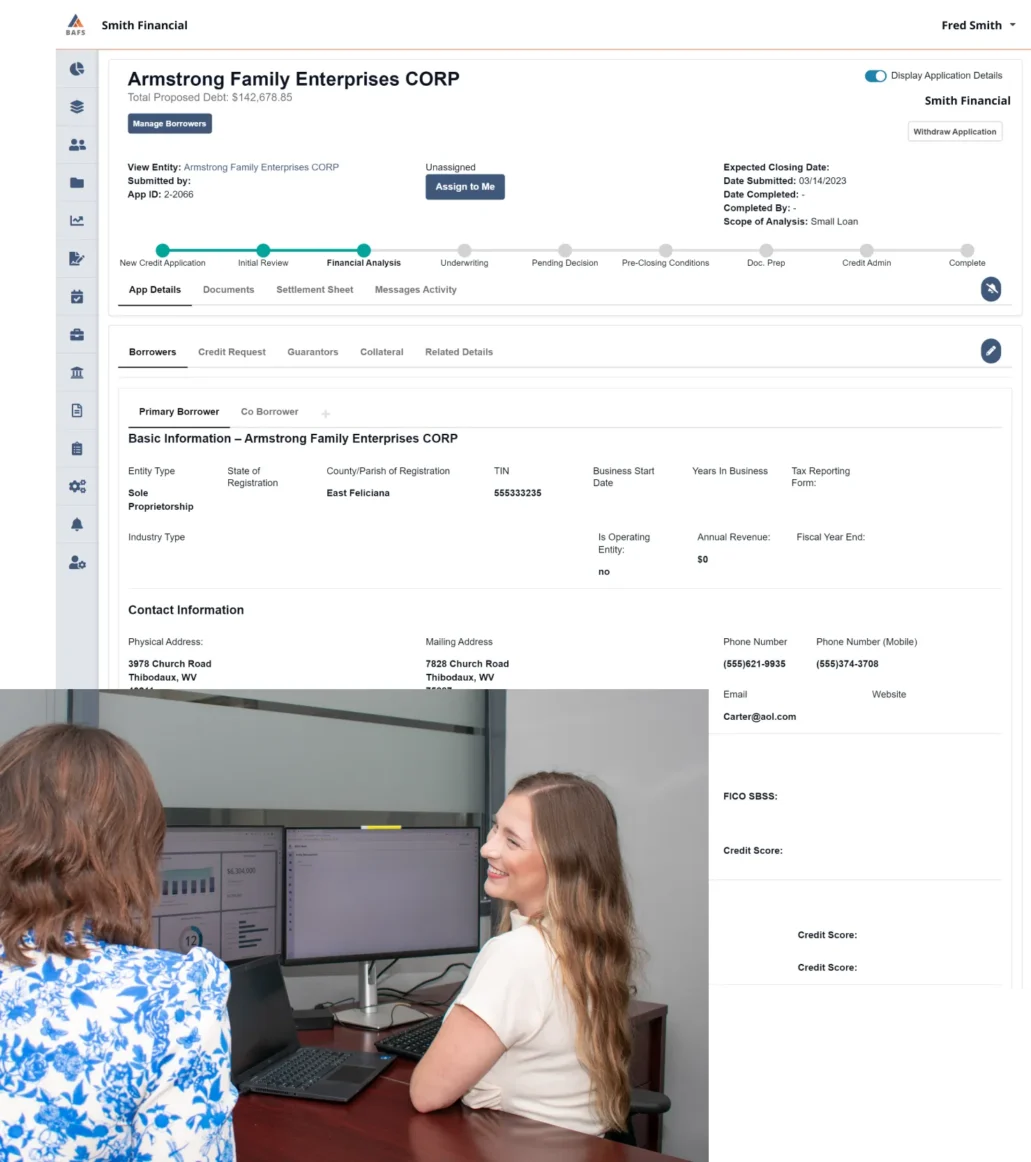

The BLAST® software platform is BAFS’ proprietary, cloud-based lending operating system designed specifically to empower our partner financial institutions through improved efficiency, compliance, and customer relationship management; fueling growth and driving profitability. BAFS developed BLAST® to guide the path of a loan from application and analysis, through underwriting, document preparation, and credit administration.

What are the features of BLAST®?

- Financial spreads modeling with OCR efficiency

- Credit memo modeling

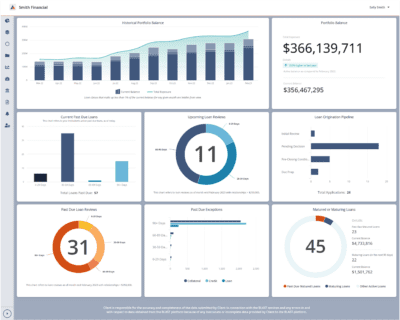

- User dashboards

- Entity management

- Full LOS workflow

- Document administration

- Tickler and exception management

- Collateral and asset management

- Reporting and analytics output

- Loan review workflow

What services does BAFS provide?

- Portfolio review

- Loan review due diligence

- Policy and procedures design/implementation

- Policy and procedure review (annual)

- Exam assistance

- Credit risk rating system development, review, and update

- Regulatory response

- Loan policy and procedures maintenance

- Problem loan management

- And more

What packages does BAFS provide?

The Essential Package: If you’ve got a commercial lending team in place, but need technology, the Essential Package is for you. This package empowers your financial institution with our proprietary, cloud-based lending software, BLAST®, to fuel your growth and boost profitability.

The Assurance Package: If you have back-office support, but not for every function, the Assurance Package is what you’re looking for. This package supports your team with cutting-edge lending technology alongside the guidance of BAFS’ experienced administrative experts.

The Alliance Package: The Alliance Package gives financial institutions the commercial lending technology and services they need to build and maintain a personalized Business Services Department.

What is BAFS’ history?

BAFS historically served as the commercial lending back-office for financial institutions, providing services such as loan origination, underwriting, loan reviews, and more. Now, financial institutions are also able to utilize BAFS’ proprietary cloud-based lending platform, BLAST®.

BLAST® was initially developed in 2014 to support client loan servicing. Platform capabilities have since been expanded for direct client use, allowing BAFS’ clients to choose between BAFS’ software, services, or a combination of both.

Want to learn more about BAFS’ industry-first market expansion? Read more via Yahoo! Finance.

Who comprises the Senior Leadership team at BAFS?

With decades of combined financial management and commercial lending experience, BAFS’ leadership team provides the skills, insights, and hands-on application expertise you need to manage and optimize your clients’ day-to-day operations and improve their loan management processes. Learn more about BAFS’ Senior Leadership team here.