Presented with your company branding, the Borrower Portal is designed to begin a conversation between you and your potential and existing clients; enabling your customers to upload documents to your institution and maintain direct contact throughout the lending process and for the life of the credit.

How We Do It

The BAFS

Borrower Portal

Kick off the commercial lending journey on the right foot. The Borrower Portal was custom-designed with your clients in mind.

An Opportunity to

Better Serve Your Customer

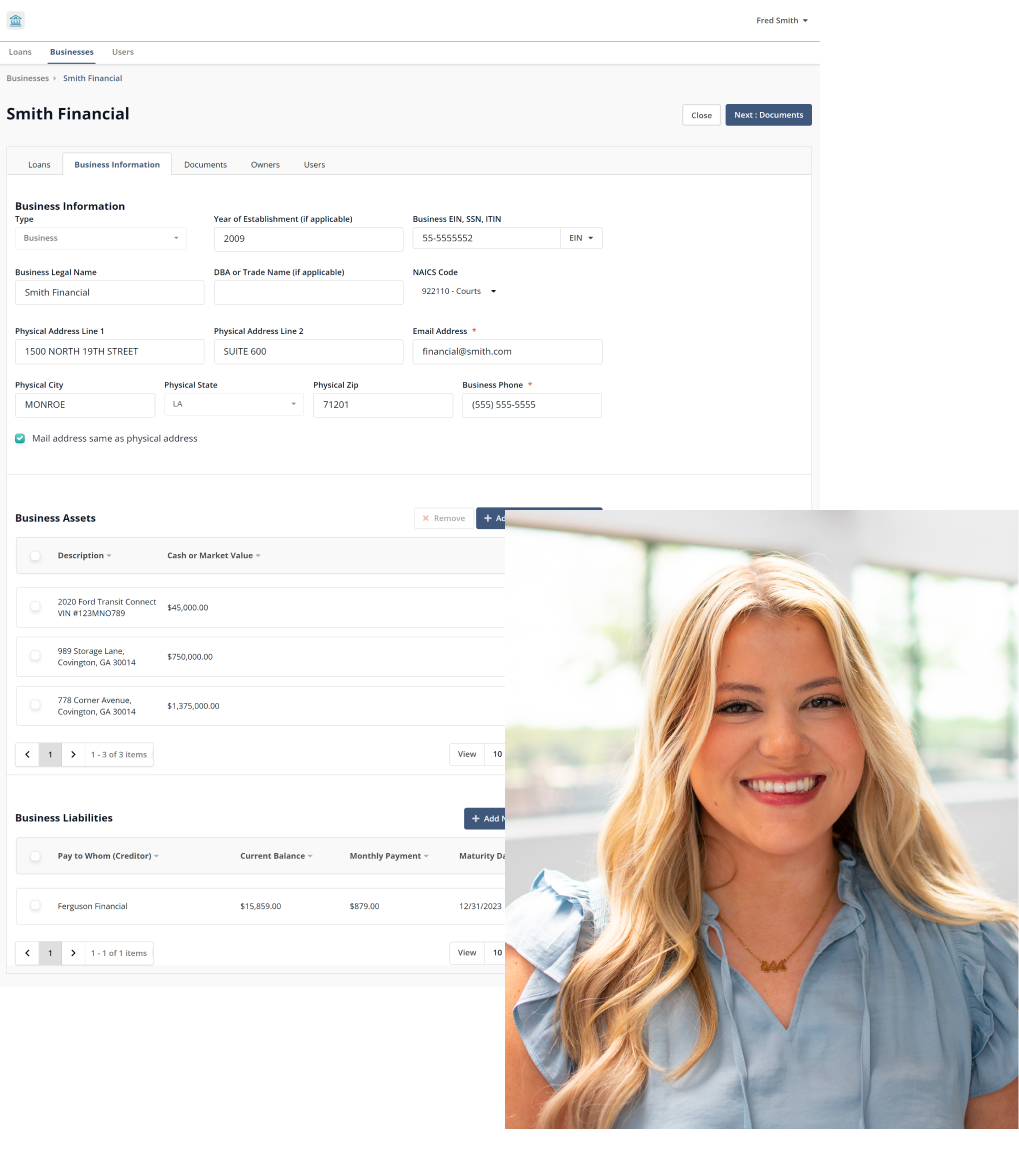

Presented As Your Institution

Presented with your logo, the Borrower Portal is built to become a part of your brand, providing an opportunity to market technology over your competitors.

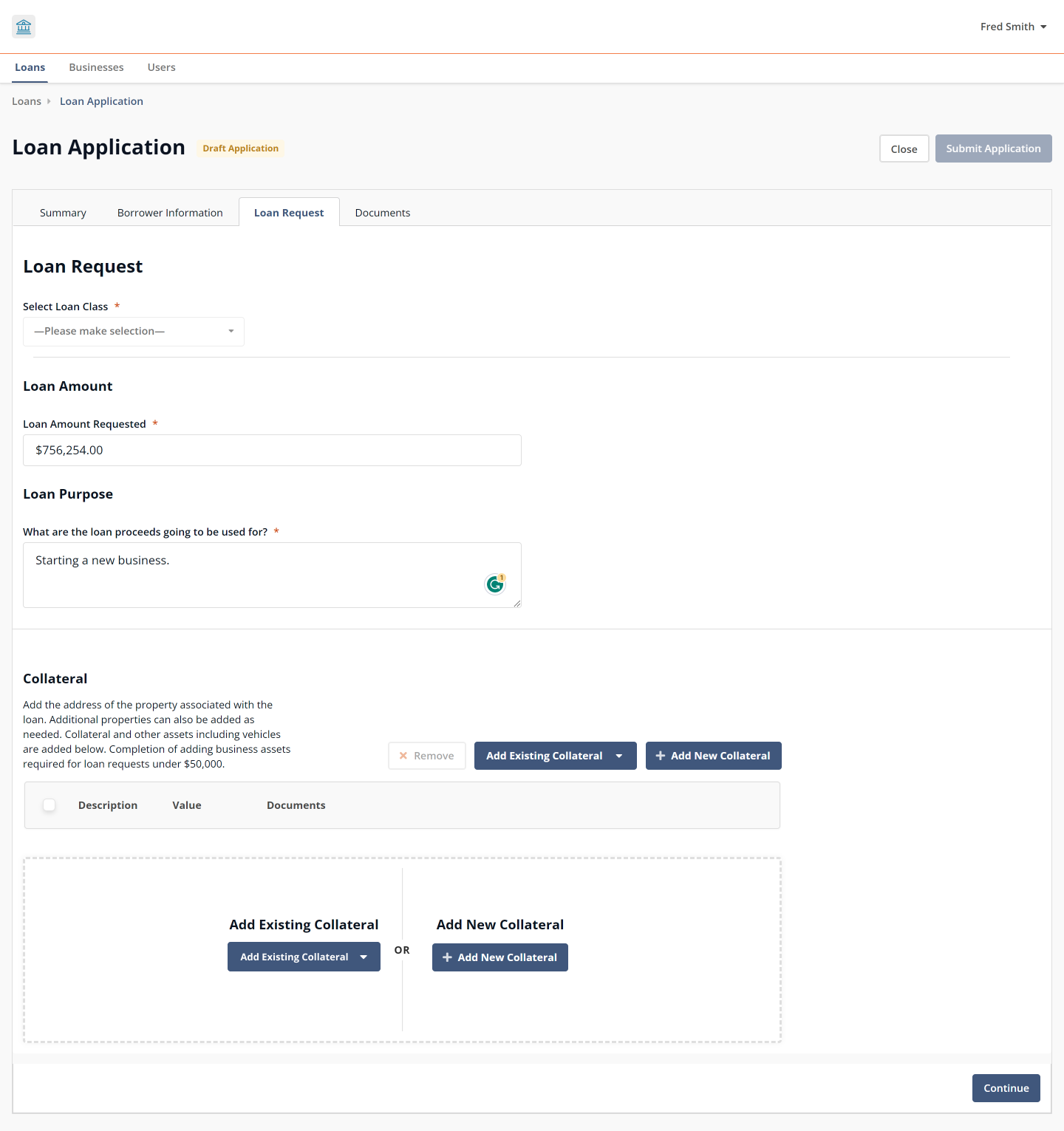

Your Single Source for Information

Provide your borrowers with a single, stand-alone data collection tool to reduce repeat requests, complete necessary tasks, and eliminate unnecessary delays.

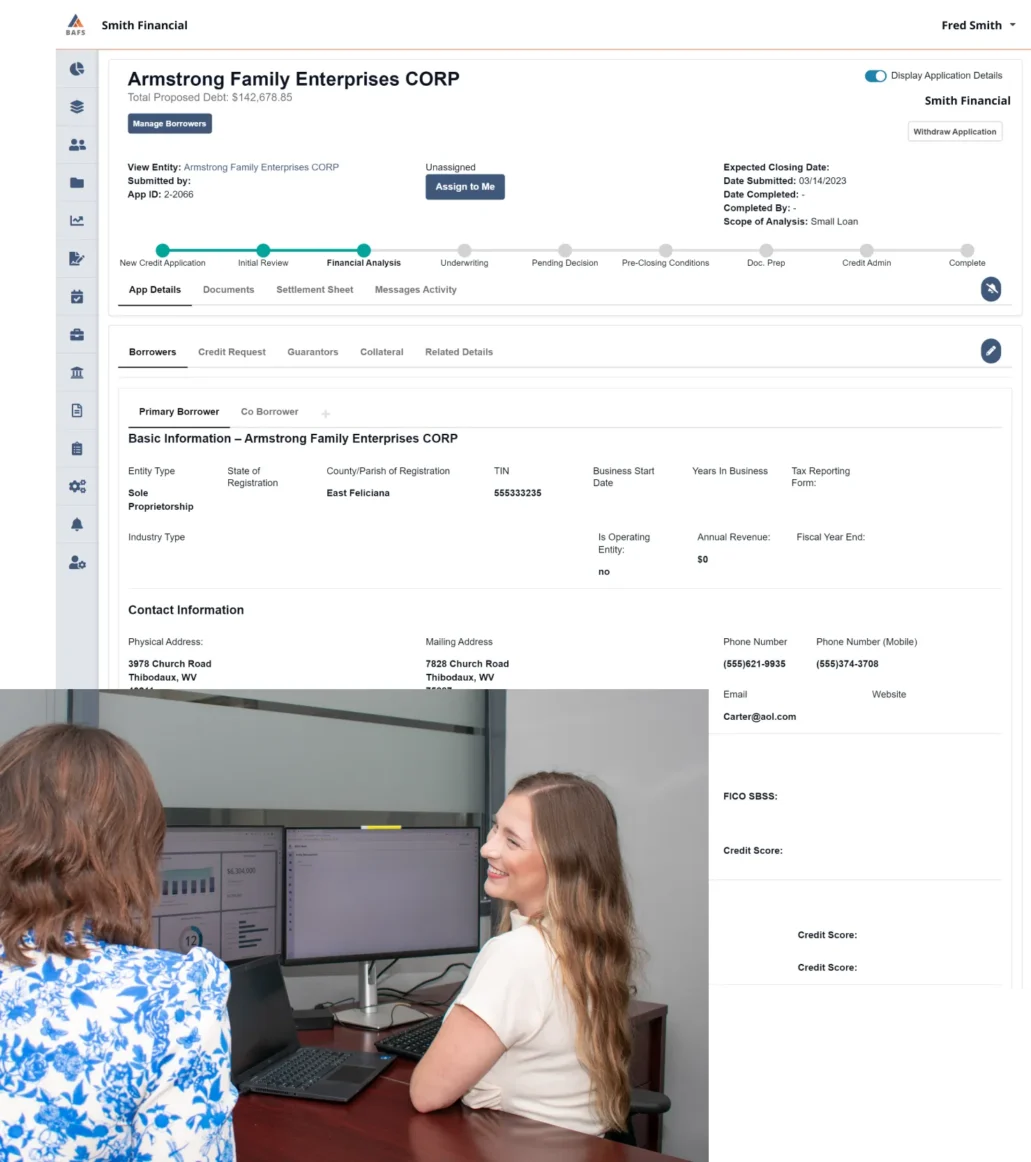

Seamlessly Connected with BLAST

Data flows directly into our proprietary software, BLAST, which streamlines the lending process and limits the need for back-and-forth communication.

Borrower Portal

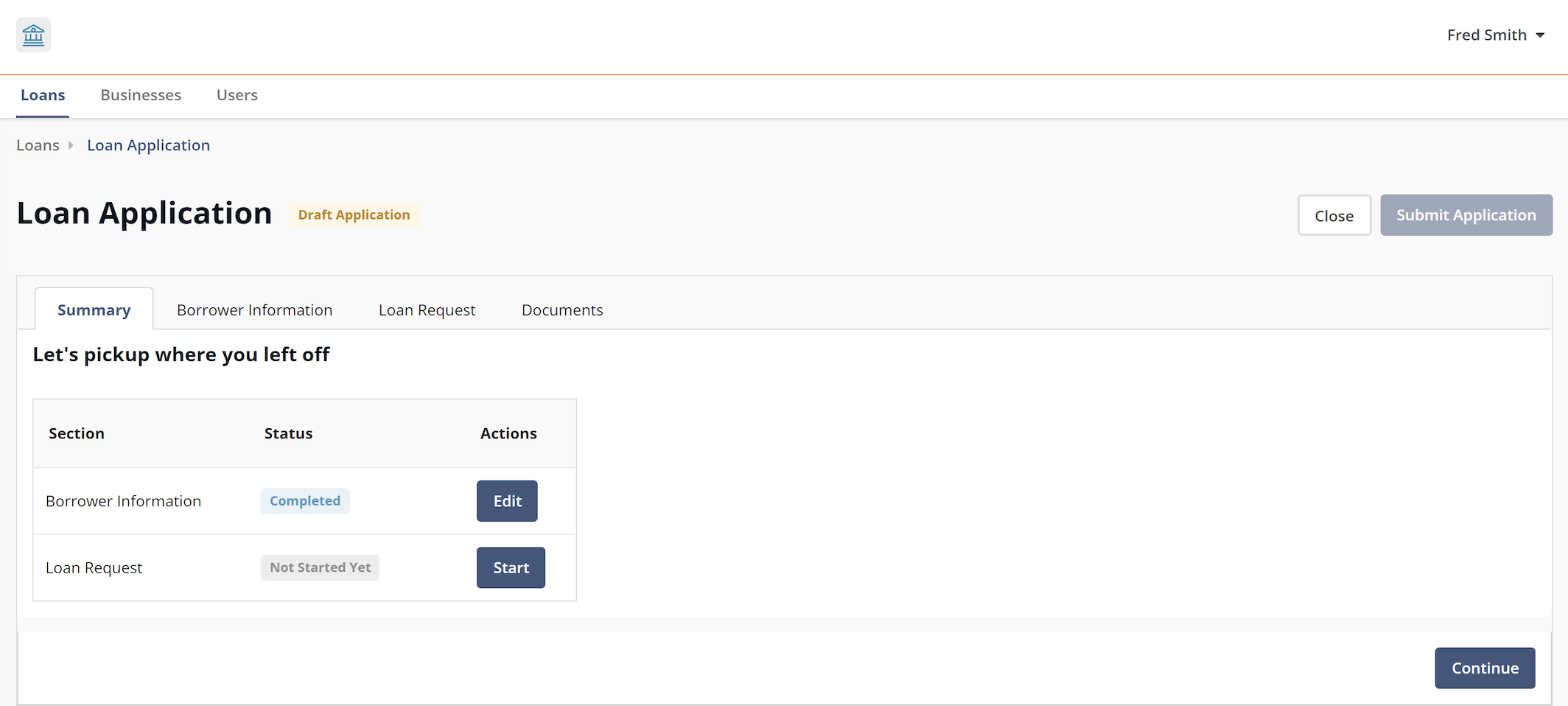

Designed to Begin the Guided Workflow

Form inputs begin the guided workflow process at the customer level. Your client is presented with a request for the exact information needed to meet their loan needs.

Borrower Portal

Shortened Time Frame

Your clients don’t have to go back and forth with your teams to understand the next step. Borrowers are guided through the loan application as they provide information and upload documents required for the loan request. The loan application flow is intuitive and efficient, shortening the time needed to complete the process.

FAQ - Borrower Portal

Borrower Portal and BLAST® are seamlessly and securely connected. Borrowers will provide information and documents for their account, entities, assets, and collateral in Borrower Portal. All of this information will be securely transferred and available to your institution in BLAST®. This eliminates the need for your institution to enter this information, saving your teams time and increasing efficiency.

The borrower will provide contact information as part of the application and you would contact them using the information provided.

When the borrower submits the application in Borrower Portal, all information related to the application, including documents, will be securely transmitted and uploaded to BLAST®. It will be available in BLAST® and will be marked as a Borrower Portal application.

Yes. The application will be available in BLAST®. It will be marked as a Borrower Portal application and will be processed just like any other application.

You can send the link to the borrower using the method you prefer. You can also put a link on your institution’s website.

Borrowers who need assistance will contact your institution directly.

Borrower Portal includes self-service profile and password management. Users will be able to update their account information and request a password reset on their own.

View BLAST® in Action

Our BLAST®-enabled suite of services offers a comprehensive solution for loan management and credit administration across application, analysis, underwriting, and document preparation. Schedule a demo with our team and see how our coordination of people and platform will grow your business!