Get the commercial lending technology and services you need to build and maintain a personalized Business Services Department for your financial institution.

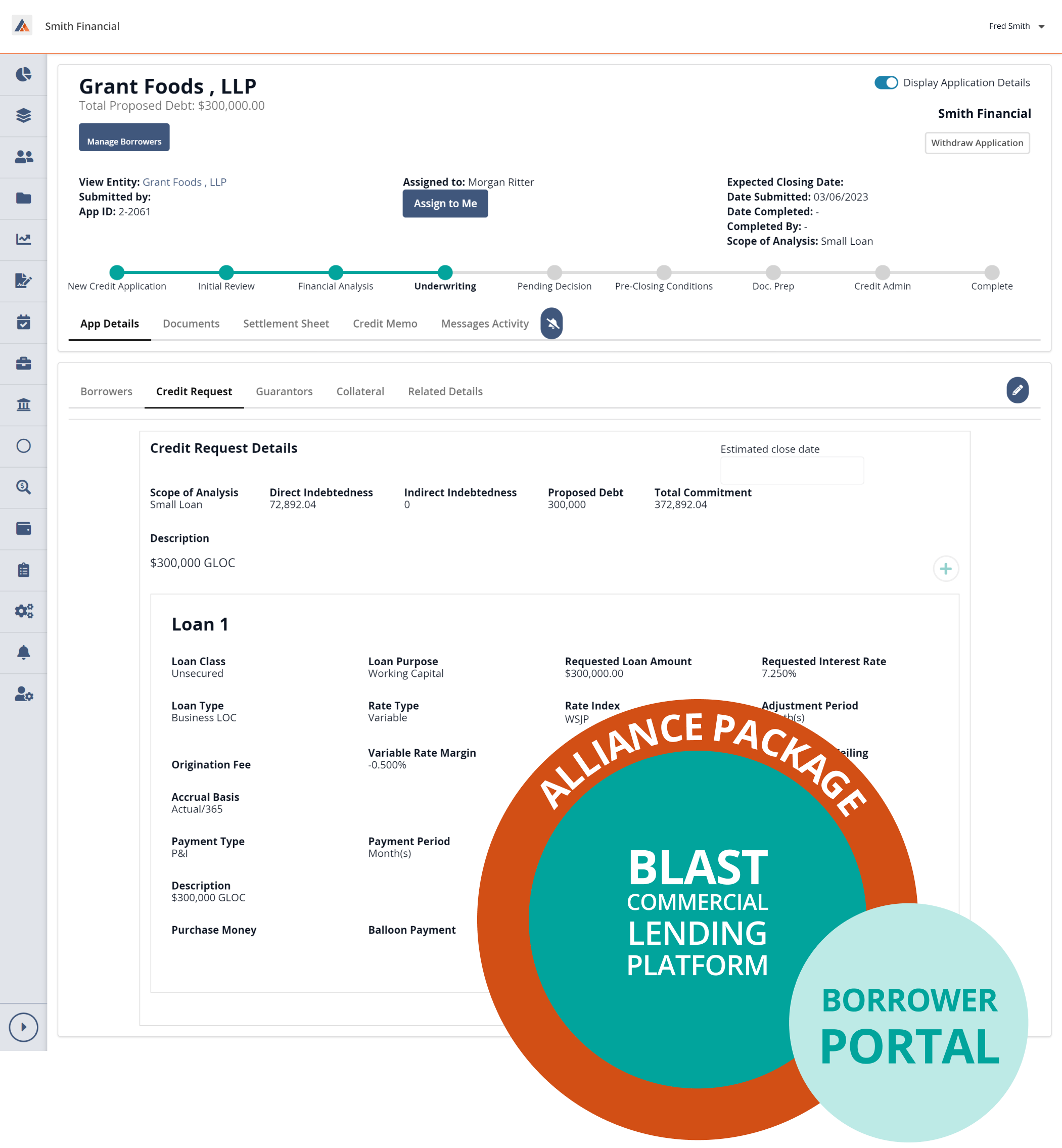

The Alliance Package

Technology and Services, When and How You Need Them

Lending Suite Services

BAFS will manage all aspects of your commercial lending from application, to underwriting, document preparation, and closing, giving you the first-rate loan management services you need to succeed!

Credit Admin Suite Services

Along with the best technology resource on the market, BAFS’ team of Credit Admin experts will provide the services you need for policy management, analytics, document administration, collateral management, and loan review.

BLAST® and BAFS, Your

Comprehensive Back-Office Solution

Struggling to break into the world of commercial loan management? BAFS’ Alliance suite provides everything you need to recognize – and capitalize on – new commercial loan opportunities. Our proprietary technology coupled with our dedicated Customer Experience teams provides an all-in-one solution for commercial loan administration.

Fully Managed Service & Support

Commercial lending can be complex. Let BAFS show you the way by acting as your in-house Commerical Loan Credit Administration department.

Access New Lending Opportunities

Benefit from a high-touch approach that helps you identify and manage new commercial lending opportunities to grow your business.

Maintain Compliance & Security

Feel confident in your Commercial Loan Program with dedicated processes for data security and industry compliance.

Technology and Service Tailored to Your Business

At BAFS, what we do is up to you. We act as an extension of your organization, creating customized solutions aligned with your business goals. In essence, we become the backend Business Services Department of your organization and manage all commercial loan tasks at a fraction of the cost of an in-house team.

Comprehensive Support for All Aspects of Loan Management

Partnership with BAFS provides everything you need to break into the world of commercial loan administration. We offer dedicated services for origination assistance, appraisals, portfolio management, underwriting, training, closing coordination, and more, all to give you the first-rate loan management service you need to succeed.

FAQ - The Alliance Package

Each department at BAFS employs the top candidates in the Finance field for a cumulative of over 100+ years of experience.

For full-service clients, ticklers can be converted into BLAST®.

Yes. Typically, the client is responsible for the travel, stay, and food costs for the BAFS team members.

Turnaround time is dependent upon the complexity of the loan type. Commercial underwriting doesn’t allow for a Service Standard. BAFS has internal checks and balances to monitor status of events and the system workflow to ensure the most favorable experience.

This is a service that we provide in-house with our experienced and certified staff.

The standard is 2-3 days. This is based on work volume and may be extended as needed.

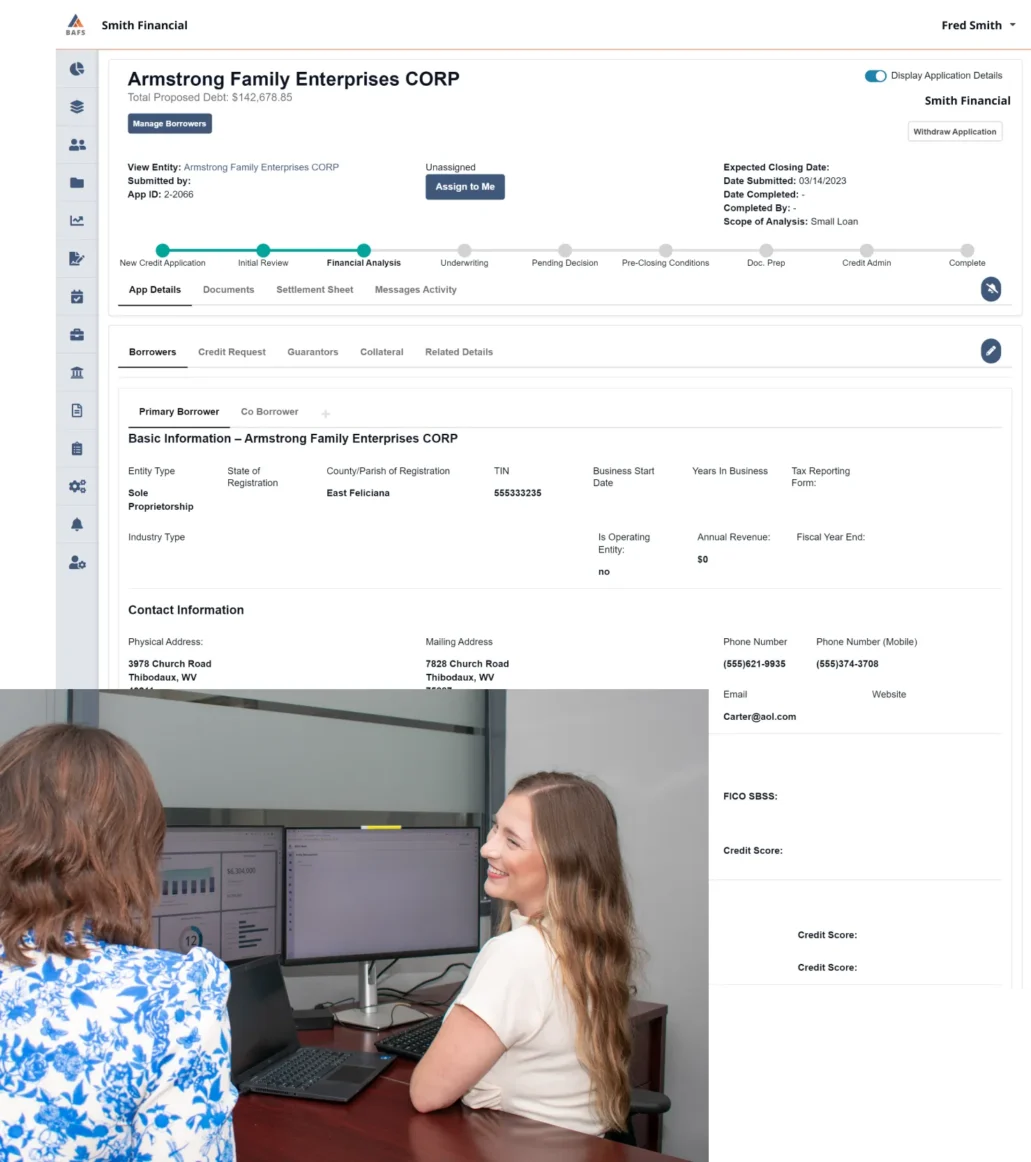

View BLAST® in Action

Our BLAST®-enabled suite of services offers a comprehensive solution for loan management and credit administration across application, analysis, underwriting, and document preparation. Schedule a demo with our team and see how our coordination of people and platform will grow your business!