People and processes driven by a shared purpose; to provide uncompromising service, one-of-a-kind technical loan management solutions, and deep strategic insight to move your financial institution forward.

How We Do It

Is How You Need

Us to Do It

How would you best describe your needs?

BLAST® Essential

Software to Complement Your Experience

You’ve made a significant investment in your team, and they know their jobs. The BLAST® Essential package is the perfect complement to your team, combining the BLAST® Borrower Portal with the BLAST® Commercial Lending Technology and Administration Platform to guide your team’s workflow from loan application to completion. BLAST® Essential will improve efficiency, complete more loans, and drive profitability.

Choose the BLAST® Lending Suite, BLAST® Credit Admin Suite, or both as part of your loan management solutions. BLAST® Essential keeps you in the driver’s seat and enables your team to do more with what you already have.

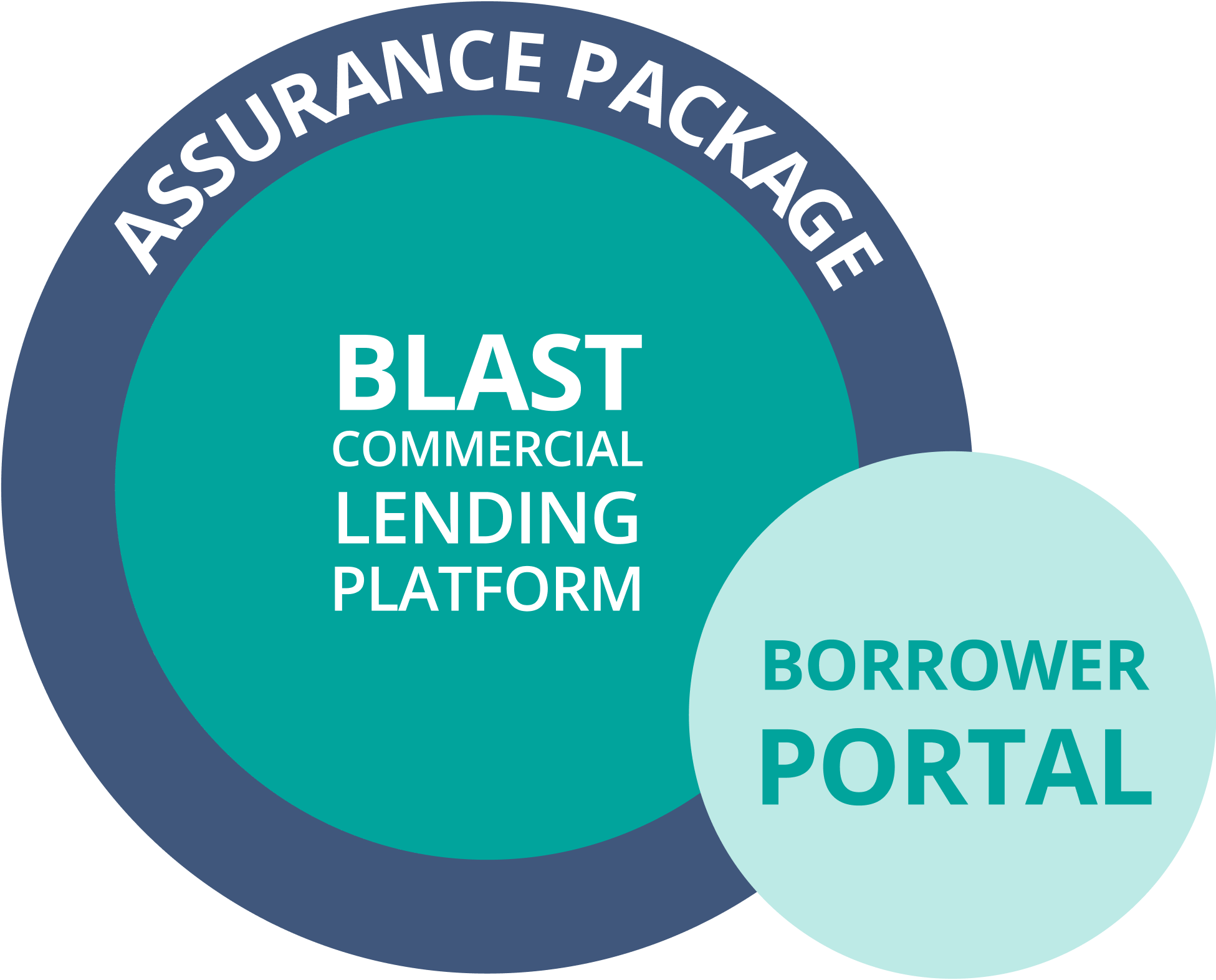

BLAST® Assurance

A Blend of Software and Support

Who says you can’t have it all? Our Assurance service tier combines our proprietary BLAST® software with hands-on support tailored to your business needs. We’ll work with you to determine what level of support will best help your in-house teams achieve their goals.

Assurance was built to support financial organizations that have developed processes in some departments but need support in others. This tier allows clients to manage certain lending functions in-house while receiving specialized support for reviews, compliance, regulatory obligations, and more.

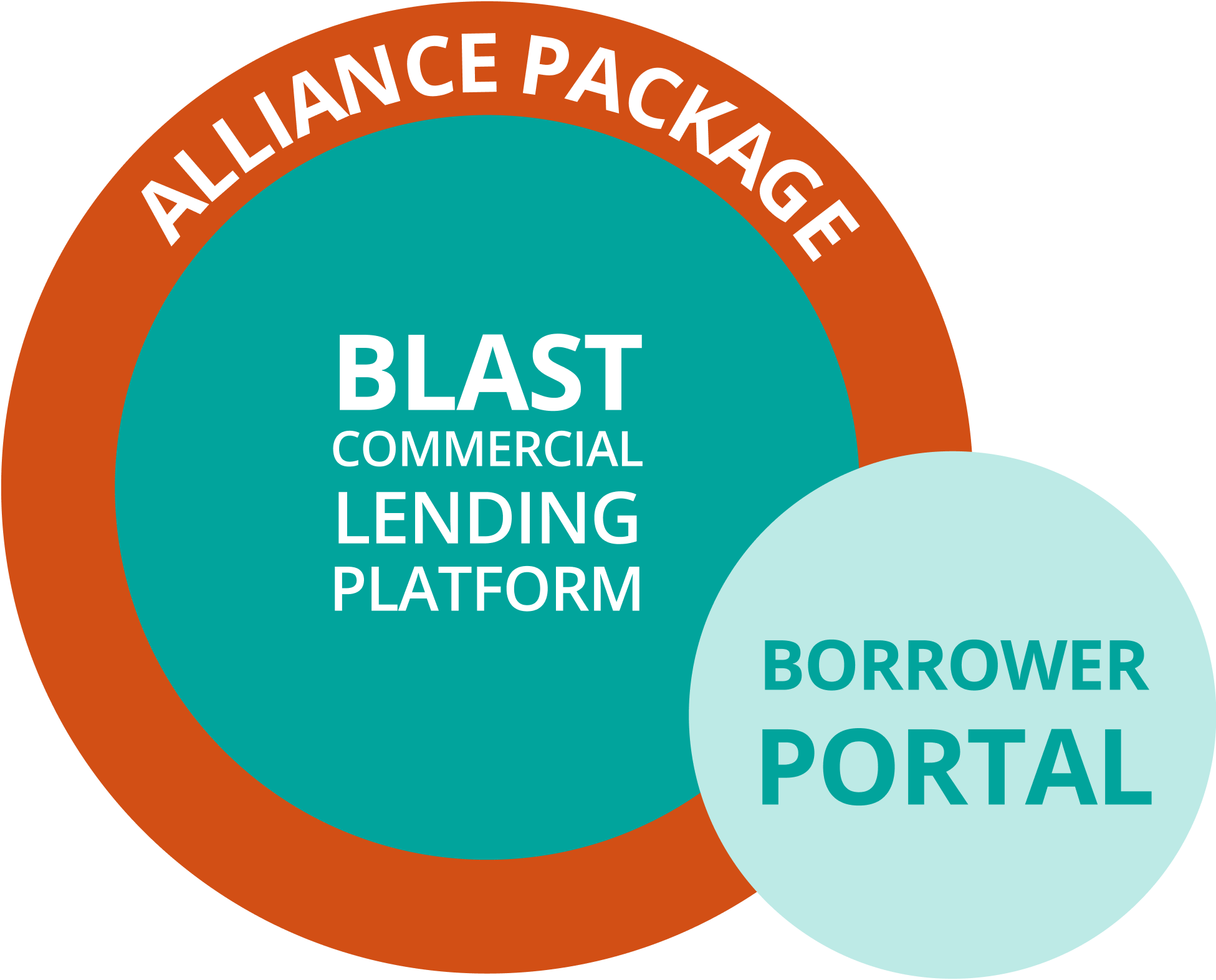

BLAST® Alliance

Your Comprehensive Back-Office Solution

For clients who need the best that BAFS can offer, we have our BLAST® Alliance package. This service tier is ideal for companies without back-office functions and those who prefer to take a hands-off approach to our services. All loan management solutions are customized to your business through a white-glove service that allows you to focus on your core business processes.

BLAST® Alliance commercial lending technology creates a fully functional back-office solution for administration across loan assistance, credit administration, document prep, annual reviews, data analytics, and more.

With BAFS’ Loan Management Solutions, You Can Drive or You Can Ride

BAFS provides a unique approach to lending support that keeps you in the driver’s seat. Leverage our platform on your terms or let us take the wheel while you focus on other business goals. Our commercial lending technology is yours to scale.

Personalized Service Available in an Assurance Bundle or As Needed in the Alliance Package

Mobile Dropdown

Loan Assistant

Choose which of the Loan Assistant services you need and let our Lending Team do the rest. BAFS’ experienced loan assistants will take ownership, freeing you up to focus on other areas of your business.

- Search and filing documents when needed for your application

- Our experts know what flood and environmental requirements have to be met

- UCC requirements will be fulfilled by a team that works this process constantly

Underwriting

BAFS’ seasoned Underwriting Team can take this difficult and time consuming work on for you.

- Whatever type of underwriting analysis is needed, our senior underwriters do it every day

- Experts in Commercial Real Estate

- Constant testing through real world lending ensures our models are accurate and correct

- BAFS’ Government Guarantee team are experts in all aspects of USDA, SBA, & Government Guarantee lending programs

Document Preparation

BAFS’ dedicated team does nothing but loan document preparation so you have what you need, when you need it.

- Experts in every type of lending document, our team does nothing but document preparation so you can be confident in our work

- Unsecured loan documents

- All types of property and collateral documents, we do it every day

- SBA/USDA loan documents

- Loan modification, participation, renewal

Policy, Analytics & Doc Admin

Our template-driven workflows provide your team with the oversight and management tools required to meet the needs of your customers.

- The BAFS team will ensure your policies & procedures are being adhered to properly

- Our experts also help manage ticklers & exceptions, handling clearing and reconciliation

- When you need to respond to regulators or need exam assistance, we’re on your side

Collateral Management

Meet review responsibilities while fulfilling separation of duties requirements and meeting regulatory & compliance needs.

- BAFS’ Collateral Management team does nothing but oversee and review every kind of appraisal including real estate revaluation

- Allow our team to handle your environmental review and deliver your environmental risk analysis

- We also handle your business use vehicles, equipment, and inventory

Loan Review

Need to measure the financial health of your business? BAFS has a specialized team to cover every aspect of your institution.

- Our Loan Review teams do nothing but review, specializing the analysis specific to your portfolio

- BAFS can handle all your annual term loan review as well as a third party compliance review

- All covenant compliance and industry analysis as well as a non-financial credit risk review

Get the Same White Glove Service with BAFS’ Stand Alone Products

Stand-Alone Edge Services

If you’re not looking for commercial lending technology right now, or your team is managing your current workflow, you can take advantage of BAFS’ other loan management solutions and services as stand-alone products.

- Take advantage of our team’s expertise in review and due diligence reporting.

- Do you need a review of your policy and procedures or simply a design and implementation?

- Perhaps your credit risk rating system needs to be reviewed and revised.

- Need guidance on regulatory issues and response? We do this sort of thing every day and can certainly help you.

- Need assistance with problem loan review and management? We have a team doing nothing but this.

COMMERCIAL LENDING TECHNOLOGY SOLUTIONS

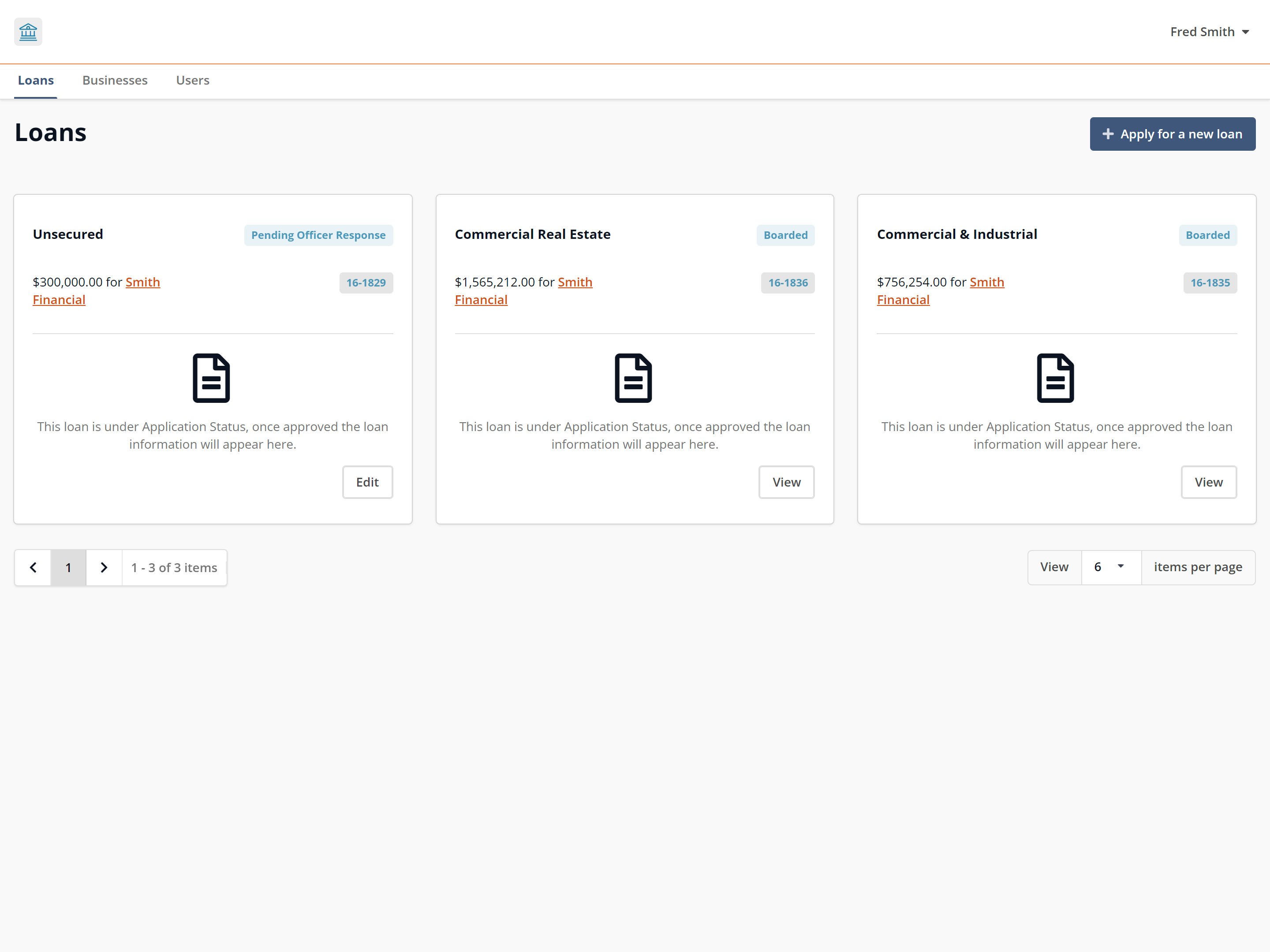

Borrower Portal

White-labeled loan management solutions with your company branding, BAFS’ Borrower Portal allows your customers to input their information and upload their documents directly, saving time and improving efficiency.

- Plugin data collection tool branded as your own

- Maintain direct contact with the borrower

- Authentication & profile management

- View existing and new ‘in-flight’ loans and applications

- Seamlessly integrated with BLAST® to upload data

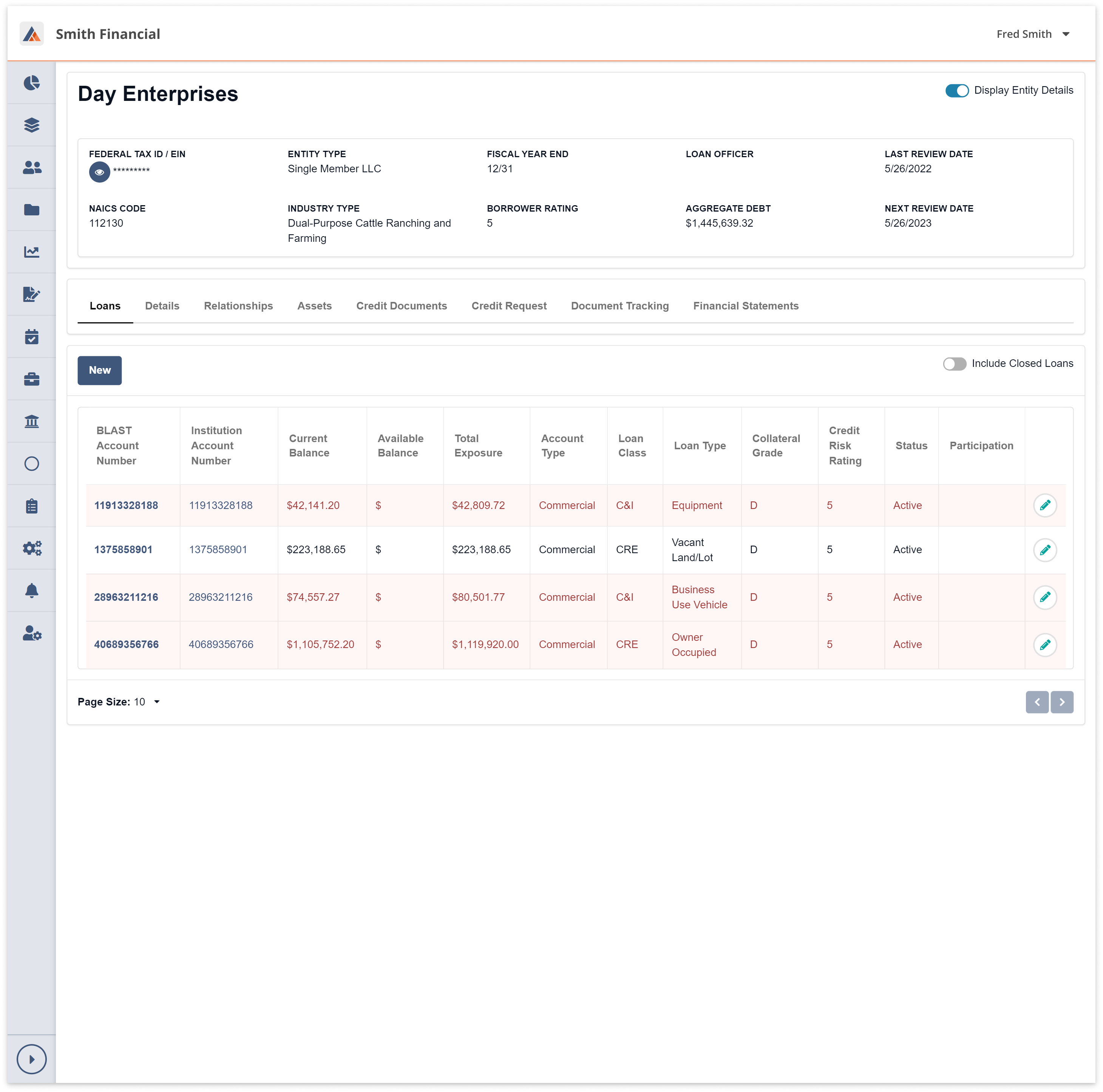

BLAST® Technology Solutions

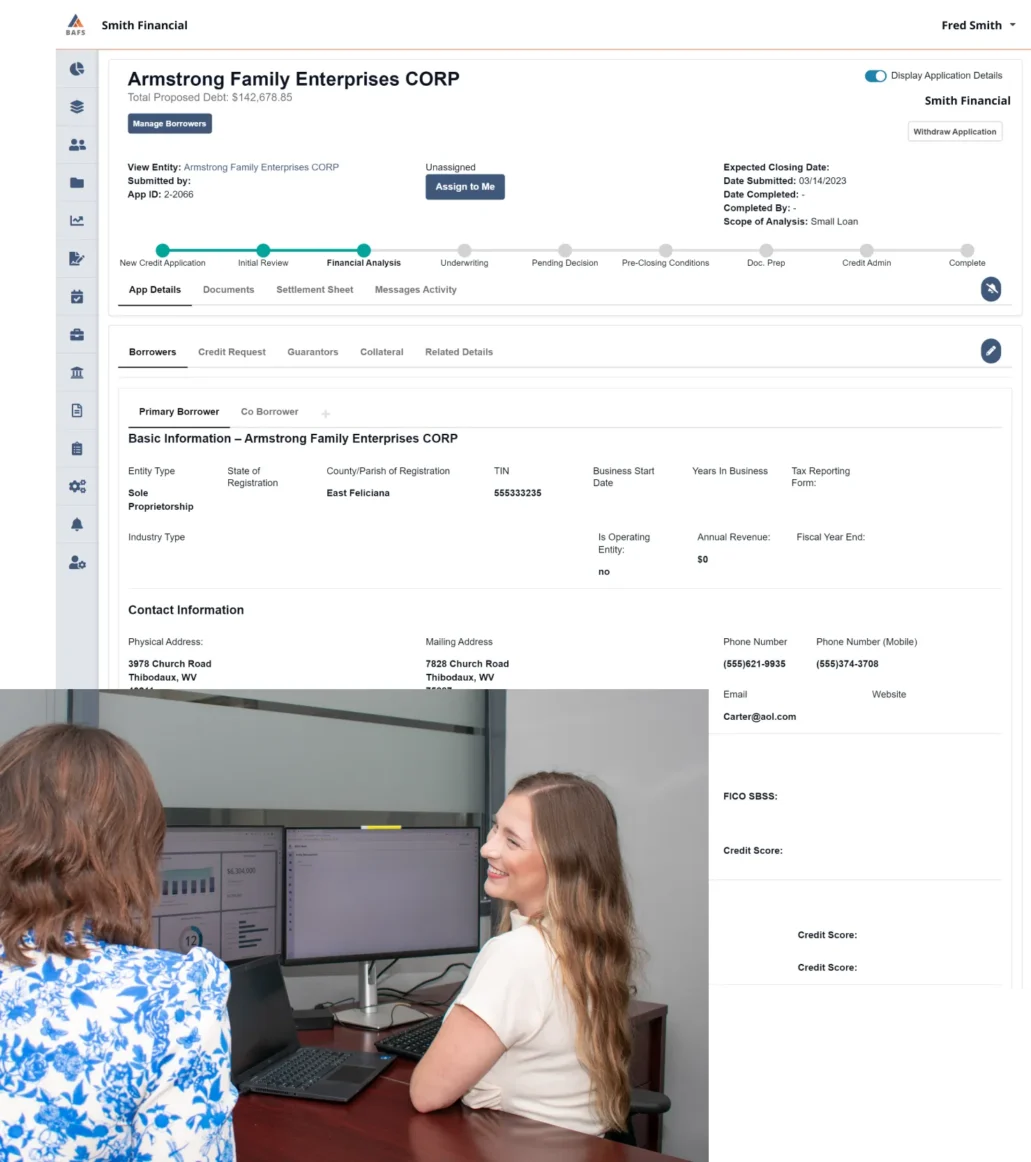

BLAST®-Enabled Lending

The BLAST® Lending Suite has been purpose-built to begin the commercial loan process and provide a guided workflow to users, reducing errors and improving efficiency. Our lenders use it, and so can yours! Our commercial lending technology helps with:

- Full LOS Workflow

- Credit Memo Modeling

- Entity & Asset Management

- Document Management

- Financial Spreads Modeling

- User Dashboards

- Portfolio Management

BLAST® Technology Solutions

BLAST®-Enabled Credit Admin

Developed for the BAFS Credit Admin team, the BLAST® Credit Admin Suite is the commercial lending technology path to ensure portfolio asset quality, acceptable compliance standards, and audit and review functions.

- Loan Administration System

- Report Services

- Tickler & Exception Management

- Loan File Imaging and Management

- Risk Rate Management

- Collateral Management

View BLAST® in Action

Our BLAST®-enabled suite of services offers a comprehensive solution for loan management and credit administration across application, analysis, underwriting, and document preparation. Schedule a demo with our team and see how our coordination of people and platform will grow your business!