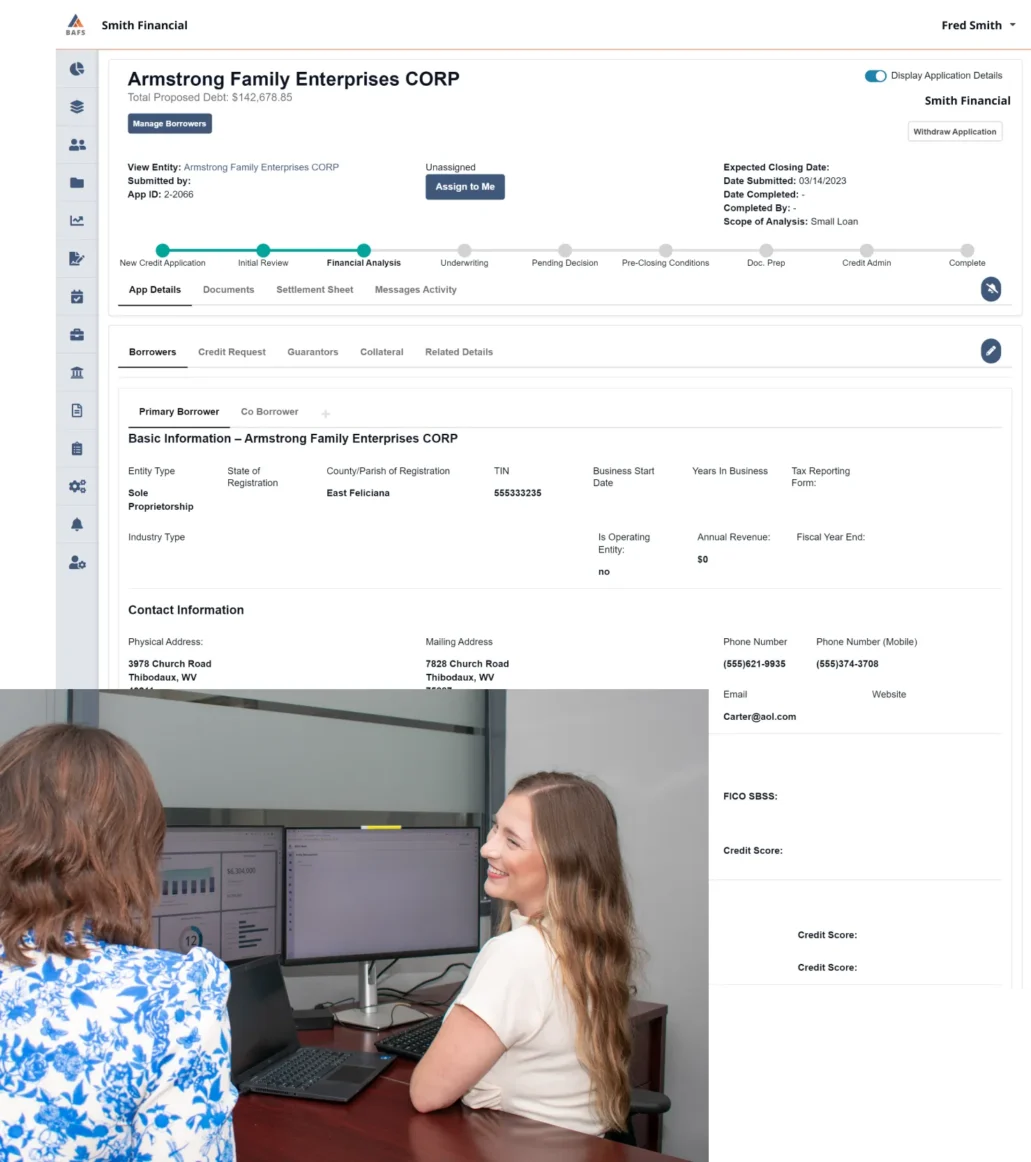

With decades of combined commercial lending experience at your disposal, our team of experts will augment your staff to create a true Commercial Loan Department within your organization, utilizing our unique commercial loan origination and loan accounting software.

Our dedicated Client Experience Team will act as an extension of your team with the goal of growing your business so that your institution becomes a leader in the commercial lending space.