You have back-office support, but not for every function. The Assurance Package supports your team with cutting-edge lending technology alongside the guidance of BAFS’ experienced administrative experts.

The Assurance Package

Coordinated

Technology & Services

Lending Suite Services

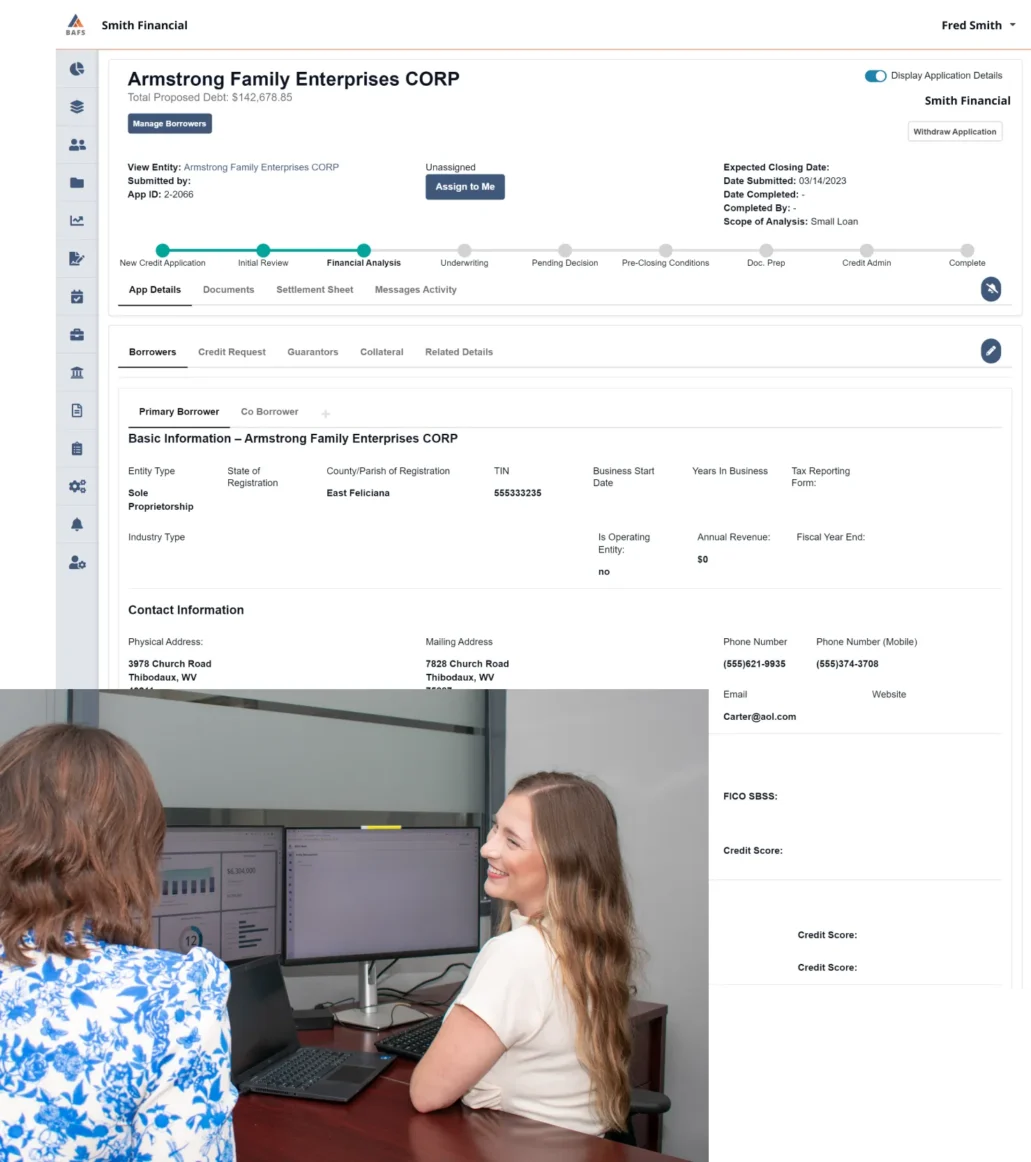

BAFS will partner with your team in all aspects of commercial lending from application, to underwriting, document preparation, and closing, giving your team the opportunity to get more done fast!

Credit Admin Suite Services

Along with the best technology resource on the market, BAFS’ team of experts will assist your post-closing teams to guide your policy, analytics, document administration, collateral management, and loan review workflow.

White-Glove Service

When You Need It

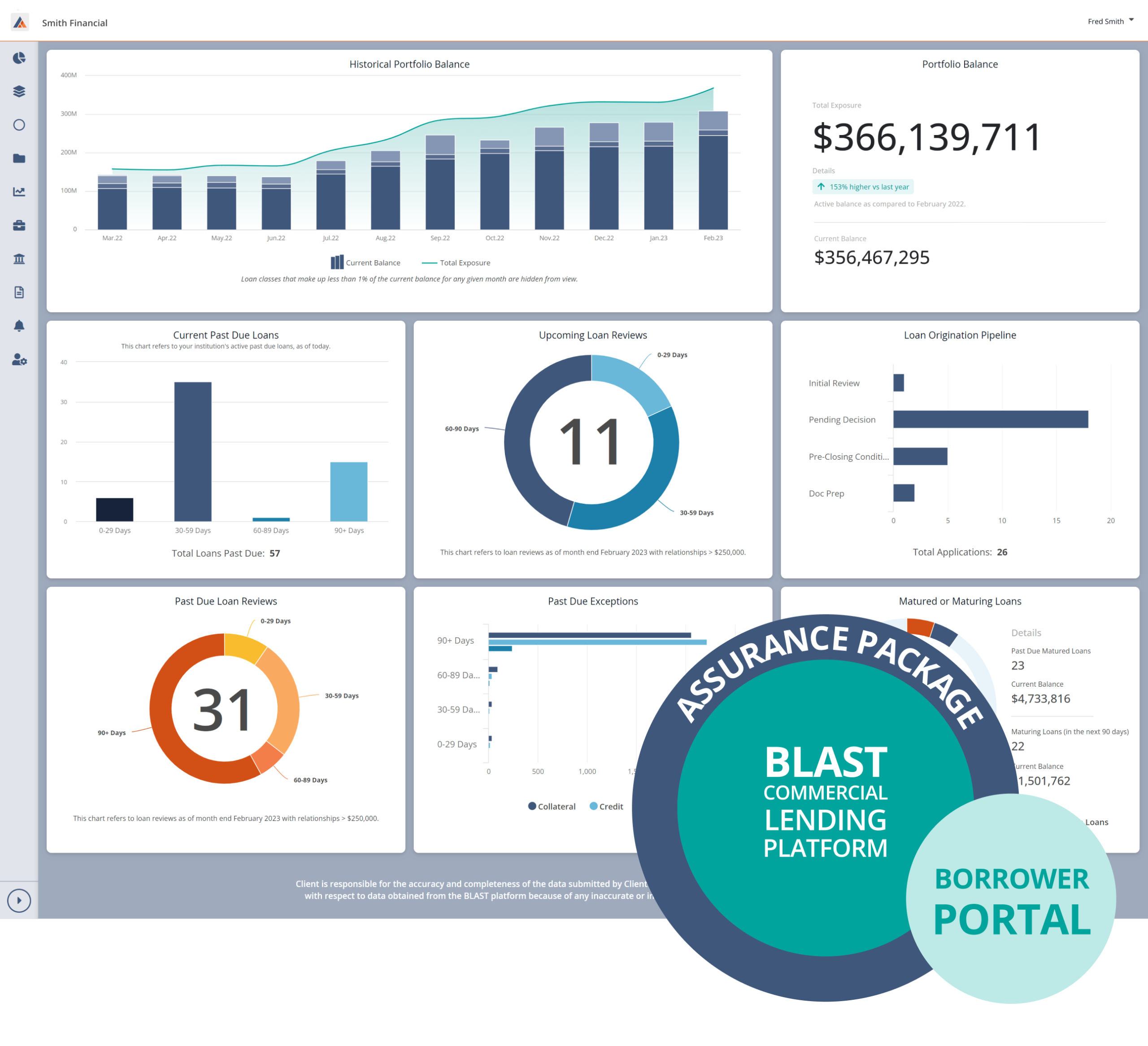

Benefit from a joint approach to commercial loan management. BAFS’ Assurance Package provides access to our cutting-edge BLAST® technology as well as dedicated management support. This coordination of people and platform ensures your business can capitalize on new opportunities while staying aligned with industry best practices.

Access New Technology

Capitalize on new opportunities with BLAST’s in-depth loan management features across credit administration, Borrower Portal, and more.

Build Long-Term Relationships

At BAFS, we aim to create relationships of value by providing access to technology, expertise, and support services that move your business forward.

Guide Your Team's Long-Term Growth

Our Customer Experience teams provide strategic insights that help your business thrive and increase market share across all lending opportunities.

Technology That Works the Way You Need It to Work

You’re in control! Most technology packages require your team to fit into some predefined box. But your organization is not like everyone else. BAFS’ Assurance Package allows your institution to utilize technology in a way that works best for the team you have today. This allows your back office to do what they do best. The BAFS team will handle the rest.

Insights From a Trusted Team of Fintech Experts

Benefit from the ongoing support of BAFS’ Customer Experience teams, composed of dedicated Client Advocate and Client Partners. These representatives develop long-term relationships with your business and ensure that your partnership with BAFS provides the service quality you expect.

FAQ - The Assurance Package

At any time in the workflow, the BAFS team can take over and handle overflow requests and/or manage the entire loan from beginning to end.

You can decide and select what pieces of the commercial lending process you need help with or would like BAFS to support. We meet you where you have the needs without the need for a complex process or system.

The BAFS team has a level of banking background and expertise like no other. The team fosters a personal client relationship with the perspective that we are your back-office team who feels right down the hall. Our technology is in-house and provides real time updates. No need for calls, voicemails, and emails that can have an extended response time.

BAFS has several clients who utilize their own risk rating models. Clients can send BAFS a copy of their risk rating model with guidance and further instructions. The model is applied as needed.

Yes. The Government Guaranteed Lending department can provide guidance and expertise to assist in this area. They can manage the steps required for a client to become an approved SBA lender.

BAFS always follows the loan policies of the client and can also provide a template that can be used for guidance and compliance. BAFS uses the latest feedback from auditors to ensure our policies are up to date.

Other BLAST®-Enabled Solutions

The Alliance Package

Get everything you need to build and maintain a personalized Business Services Department for your financial institution in this all-in-one solution.

The Essential Package

Empower your financial institution with a proprietary, cloud-based lending platform to fuel your growth and boost profitability.

View BLAST® in Action

Our BLAST®-enabled suite of services offers a comprehensive solution for loan management and credit administration across application, analysis, underwriting, and document preparation. Schedule a demo with our team and see how our coordination of people and platform will grow your business!