Navigating Risk in Commercial Lending: Best Practices for Bankers

Risk (including credit, market, and operational risk) is inevitable in the realm of commercial lending, but there are ways to reduce the severity of these risks to ensure that your financial institution is not in a vulnerable state.

Common Risks in Commercial Lending

Credit Risk and its Impact

Credit risk is the risk associated with a borrower and whether it is likely or unlikely that they will be able to repay their loan(s). High credit risk can result in the interruption of cash flow for a bank or credit union as well as increased collection costs.

To prevent this, lenders are expected to have credit risk management systems that produce accurate and timely risk ratings. A credit risk rating system is a formal process that a lending institution uses to identify and assign a credit risk rating to each commercial loan in the institution’s portfolio.

How Can My Financial Institution Prevent Credit Risk?

At BAFS, our team of experts helps banks and credit unions create credit risk rating systems that produce accurate ratings, meet regulatory expectations, and are tailored to your needs. We can also review a financial institution’s current risk rating systems and provide recommendations for updates and enhancements as needed.

Download our Credit Risk Rating System guide to learn more.

Market Risk Considerations

Market risk typically depends on external factors such as capital markets, equity markets, interest rates, etc. Many of these factors are out of our control, but there are some steps a financial institution can take to reduce market risk.

How Can My Financial Institution Reduce Market Risk?

Banks and credit unions can reduce market risk through:

- Diversifying assets: It’s important to avoid putting all of your eggs into one basket (i.e. making all of your investments in a single industry). It’s better to spread out your assets (within reason) in order to offset costs, should one industry (or multiple) suffer from losses.

- Keeping up-to-date with current market trends: It’s vital to stay informed on current market trends to effectively navigate the market. This can be done through consistently monitoring the stock market, monitoring previous banking trends both internally and externally, etc. Of course, there is no way to 100% predict market trends, but these are ways that institutions can be more aware of any changes and/or make more accurate predictions for the future.

Tip: Be sure to check out our recorded webinar, Regulatory Issues and Interest Rate Risk, for more on this topic.

Operational Risks in Lending Processes

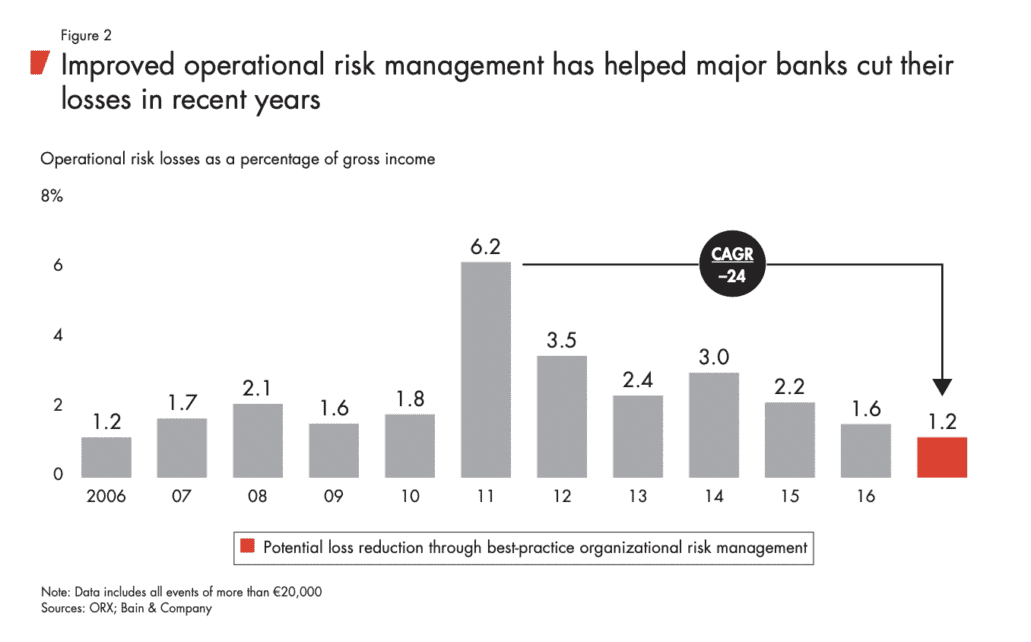

According to Investopedia, “Operational risk summarizes the uncertainties and hazards a company faces when it attempts to do its day-to-day business activities within a given field or industry.” Losses from operational risk can not only be dangerous in a monetary sense but can also impact a financial institution’s reputation and even threaten its very existence (Bain & Company).

Operational risk is something that financial institutions have to tackle in general, but when it comes to commercial lending specifically, operational risk can result in dangerous outcomes. Major operational risks include credit operations, liquidity management, and regulatory readiness and compliance.

How Can My Financial Institution Reduce Operational Risk?

- Conduct ongoing training and skill development: Financial institutions should prioritize training their staff to be up-to-date on the latest policies, regulations, and procedures that apply to their department. For example, those in the IT sector should be in the know of the latest cyberattack methods, and bankers should be clued up on the latest compliance requirements. Mandatory monthly or quarterly training for each department will ensure that your bank or credit union is reducing operational risk.

- Develop a risk assessment framework: Your financial institution should ensure that it has an effective operational risk assessment framework in place, which should include tracking current or potential risks across all departments in the company. Once risks are identified, a risk management process should be developed in order to prevent or reduce future risks.

- Balance technology and human judgment: Balancing technology and human judgment is vital for operational success. While technology provides huge benefits, such as automation, data analysis, and reduced human error, human oversight is a necessity for ensuring ethical practices, monitoring performance, identifying areas for improvement, and more.

- Regulatory compliance: Focusing on regulatory compliance is important when reducing operational risk as it will help your bank or credit union demonstrate due diligence and pass audits, upholding your institution’s security and ethics. At BAFS, we know what regulators expect and have extensive knowledge of the regulatory agencies’ examination manuals and handbooks, along with Federal Reserve Supervision and Regulation letters. We use our knowledge of these resources to help you create a commercial loan policy and procedures manual that incorporates all required elements and regulatory concerns while tailoring the policy to your institution’s lending activities and parameters. Download our free Regulatory Compliance guide to learn more.

Role of Commercial Lending Software in Risk Management

Enhance Decision-Making with Technology

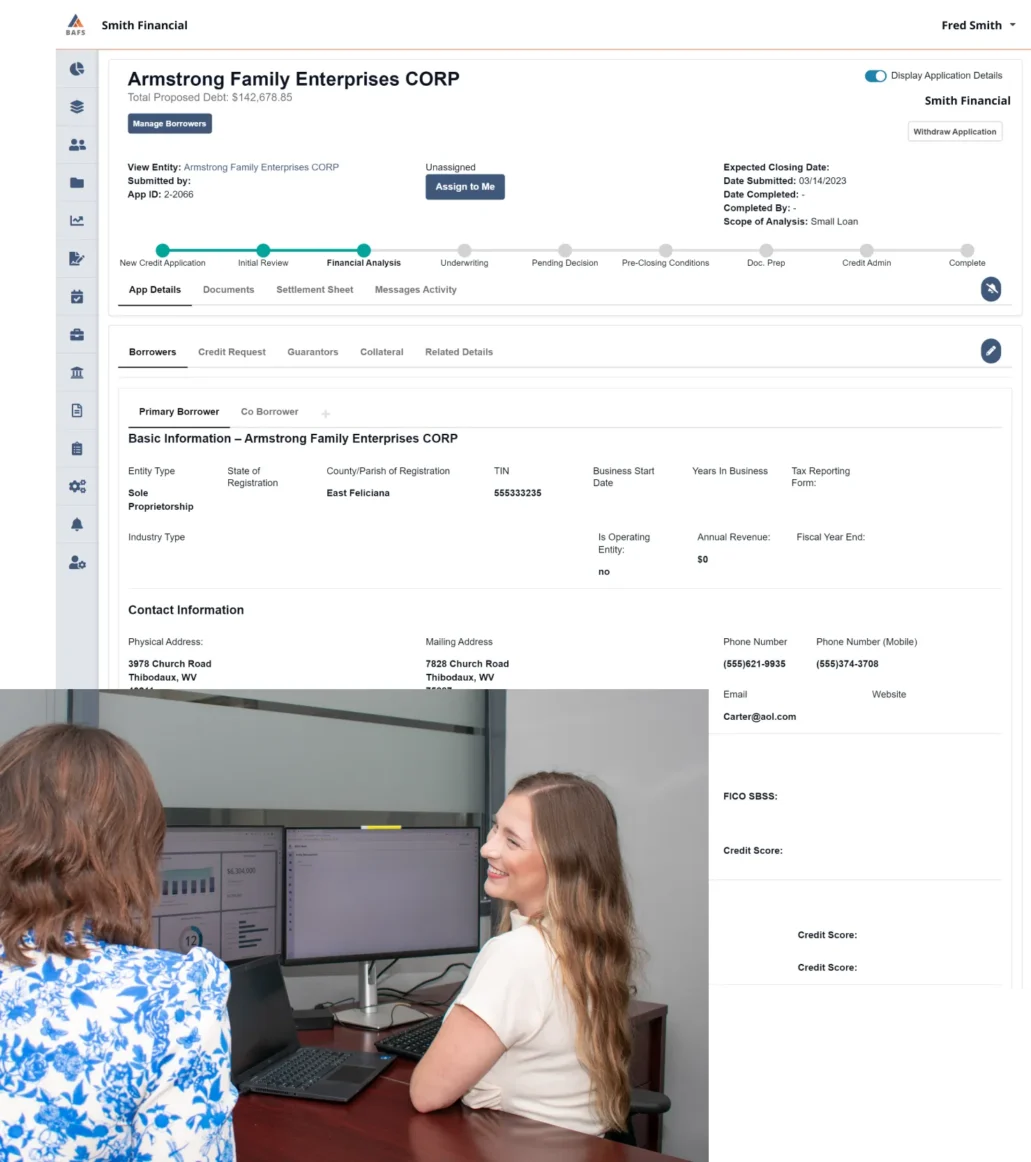

Commercial lending software has many benefits, including reducing risk. Oftentimes, commercial lending software holds data that analyzes past and current loan trends in order to provide insight into potential future challenges. This enables future decision-making to be based on reliable data.

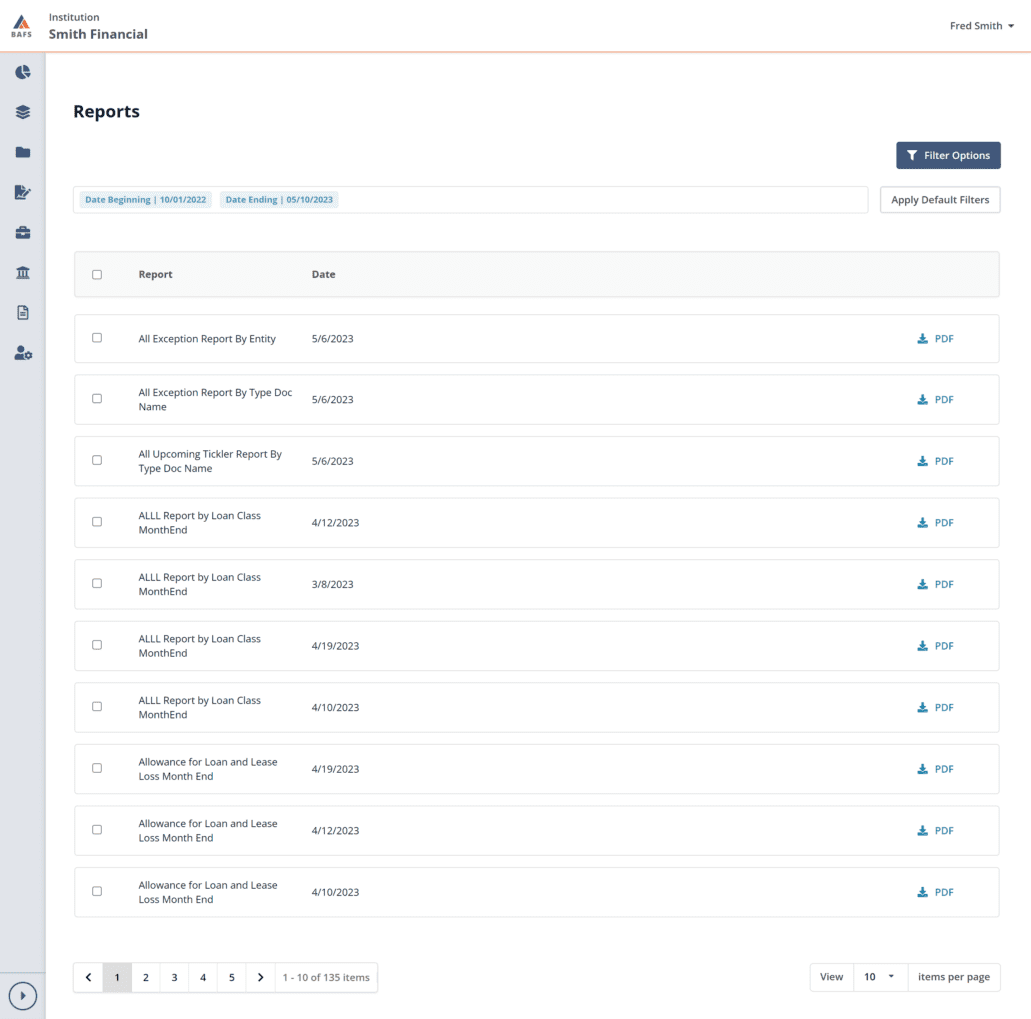

Software Solutions for Compliance and Regulatory Requirements

BAFS’ proprietary software, BLAST®, has reporting capabilities that will help your institution align with compliance and regulatory requirements.

Conclusion

Key Takeaways

In conclusion, there are many areas of risk when it comes to commercial lending, but there are a multitude of ways that your bank or credit union can reduce your level of risk. By reducing credit risk, market risk, and operational risk through the key points outlined above, your financial institution can reduce the likelihood of dangerous outcomes.

Final Thoughts

With BAFS as your commercial lending partner, you can rest assured that your commercial lending program will adhere to current regulations and compliance requirements.

We offer customized options for your program where you can utilize our proprietary commercial loan origination and loan accounting software, BLAST®, our services, or a combination of both.

Did you know?

We recently launched the Borrower Portal, BAFS’ online platform designed to link a lender and a borrower.

White-labeled with the lending institution’s branding, BAFS’ Borrower Portal allows borrowers to input loan application information, upload documents directly to the lender, and submit the loan application. The Borrower Portal is seamlessly connected with BLAST®, BAFS’ cloud-based, proprietary lending platform that directs financial institutions’ workflows, guiding the path of a loan from application and analysis, through underwriting, documentation prep, and credit administration.

Contact us today to learn more about our commercial lending software and/or services, or click here to schedule a free, live demo of BLAST®, the Borrower Portal, and more.

Commercial Lending, Done Your Way

If you’re interested in learning more about BAFS’ commercial lending software and/or services, contact us today.