Loan Management Solutions: A Guide to Improving Lending Operations

Introduction

Challenges in the Lending Industry

The lending industry poses many challenges, including market conditions, ensuring compliance, constantly changing regulations, and finding the right loan origination software and service provider.

According to Live Vox, “In 2024, large financial institutions started to realize how important integrating digital lending was. Financial institutions could not do business without integrating online actions into their core.”

Even though cost-effectiveness is a major challenge for many banks and credit unions in the current economic climate, online lending “…reduces the cost to originate, process, close, and deliver loans. It can also increase productivity” (Live Vox, 2024).

The Importance of Efficient Loan Management

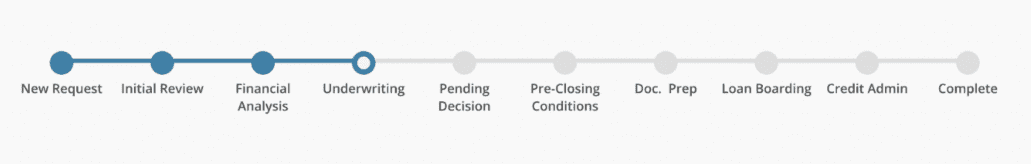

Efficient loan management is critical to running a commercial lending program. Efficient loan management will reduce loan application redundancy and accelerate and smooth out the lending cycle. The lending process has been known to be slow and difficult, but with the right commercial lending software and service provider, it can be simplified.

Understanding Loan Management Solutions

Key Components of Effective Loan Management Software

Effective loan management software should tick a few essential boxes — it should streamline the loan application process, enhance customer experience, improve risk management, and adhere to compliance requirements.

BAFS’ BLAST® software ensures that your institution will have a simplified commercial loan program.

The BLAST® Lending and Credit Admin Suites have been purpose-built by commercial lenders for commercial lenders. It is not just a BAFS logo printed on some technology we’ve purchased; BLAST® was designed specifically with your teams in mind. Our mission is to empower your teams through improved efficiency, compliance, and customer relationship management to fuel new growth and drive profitability.

The Impact of Loan Management Software on Lending Operations

Streamlining the Application Processes

Faster Loan Approval Workflows

When documentation is handled using automation, this results in a faster loan approval workflow, likely increasing the number of loans your institution closes.

Enhancing Customer Experience

An effective and efficient loan application interface should be user-friendly, have an intuitive workflow, and provide clear next steps. Not only will this make the user experience better, but it will also prevent constant back-and-forth communication between you and your client.

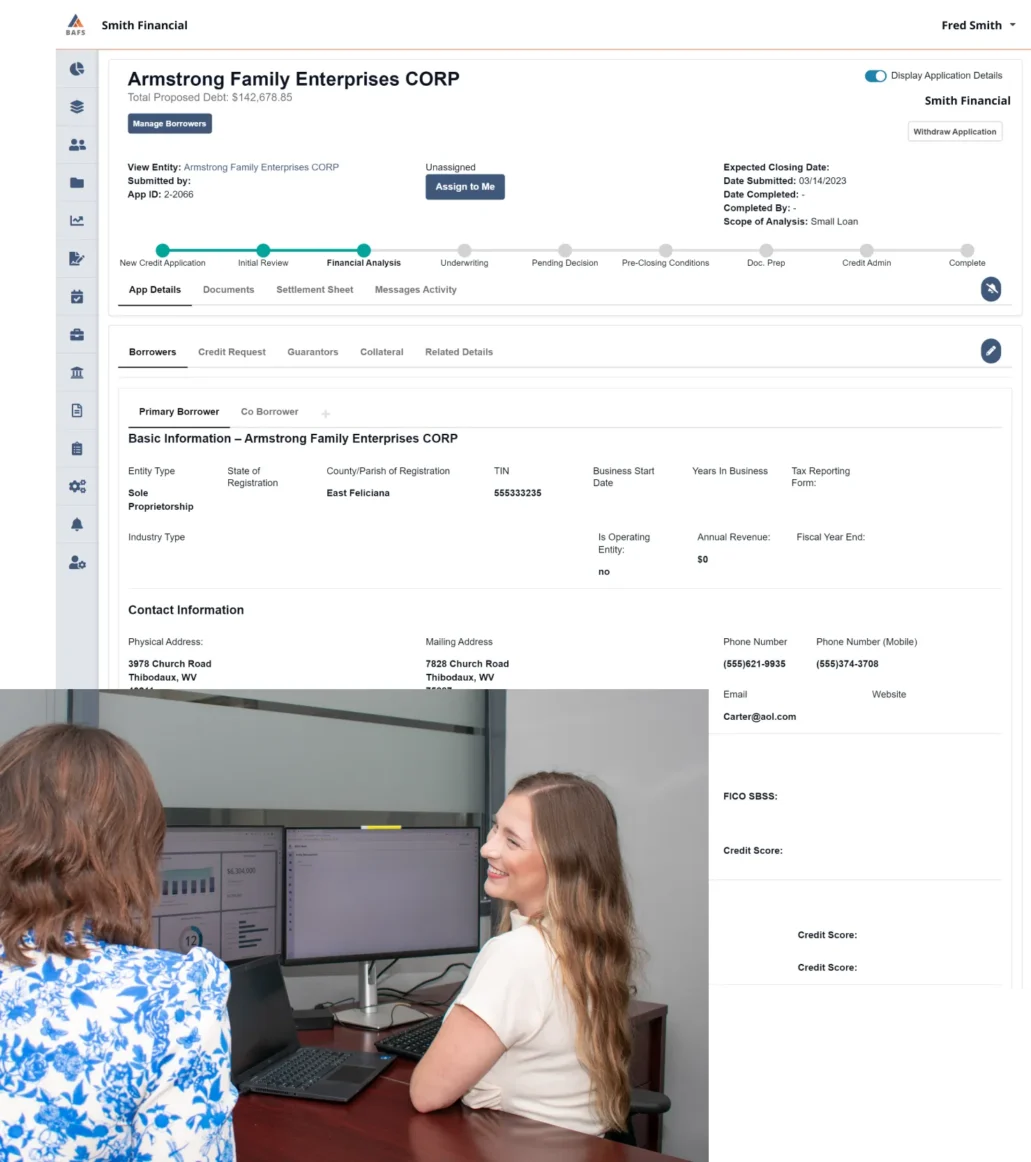

BAFS’ BLAST® software ensures that users are guided through the entire loan process in a simple and easy-to-understand workflow. And if your team has questions, our experts are here to help with training and continued education.

Key Features of Effective Loan Management Software

Automation

With automation, you can forget about dealing with hours of paperwork, delayed processing, and human error. Loan management software automation enables your institution to process loans more quickly and efficiently.

BAFS’ software, BLAST®, allows financial institutions to accelerate loan processing with our intuitive workflow.

Real-Time Analytics and Reporting

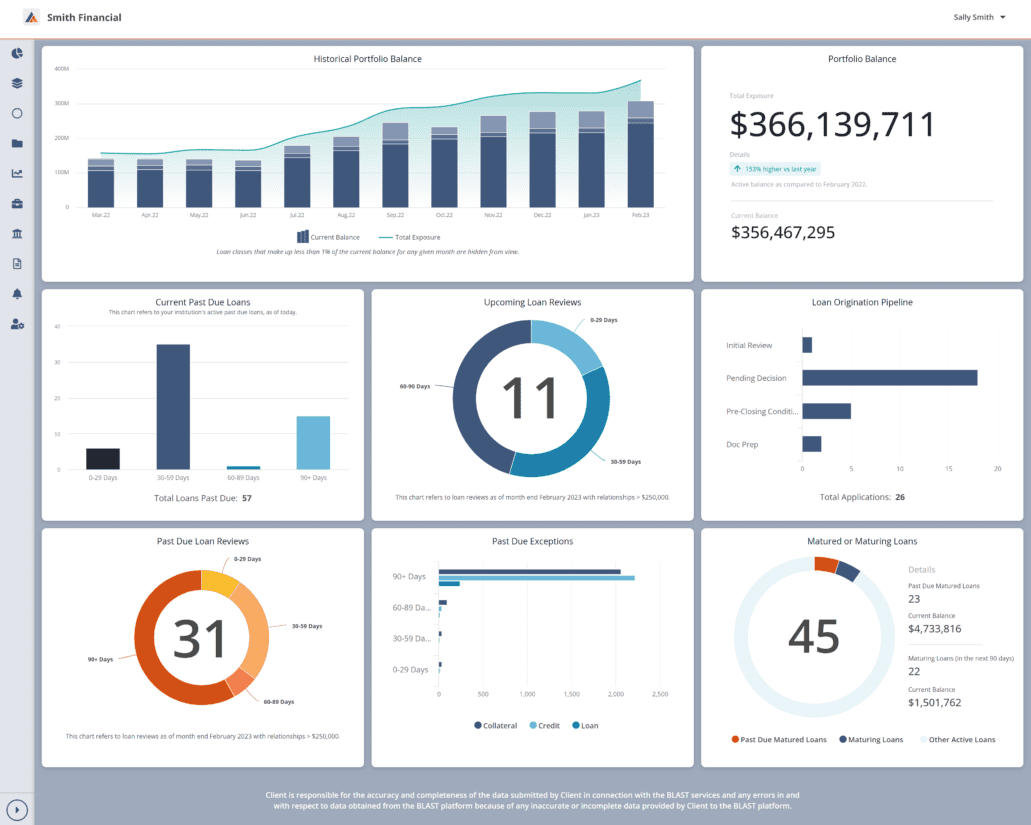

BLAST® has real-time analytics and reporting features that will help you have a clear overview of your institution’s loan portfolio.

Dashboard Examples for Monitoring Portfolio Loan Health

BAFS’ BLAST® dashboard allows you to stay up-to-date with your institution’s portfolio health, from aggregate balances and concentrations to current past-due loans to loan origination pipeline statuses. This way, you can get an essential overview of your clients’ loan status without going to multiple locations.

Integration Capabilities

BAFS recently launched the Borrower Portal — a commercial lending platform designed to link commercial lenders directly to borrowers. The Borrower Portal is seamlessly connected with BLAST®, BAFS’ cloud-based, proprietary commercial lending platform.

The BAFS Borrower Portal allows borrowers to input loan request information, upload documents, and submit loan applications. Borrowers are guided through each step of the loan application as they provide information and upload documents. The loan application flow is intuitive and efficient, shortening the time needed to complete the loan process.

How BAFS Helps With Implementing Loan Management Solutions

Assessing The Needs

Identifying Gaps in Current Operations

Our team of lending experts can analyze your current loan program (whether you have one in place or you’re starting from the ground up) and will assist with filling in the missing gaps. Whether you need help establishing your loan program, or you need assistance with enhancing your current loan program with our commercial lending software and/or lending and credit admin services, we’re here to help you. Contact our team today to get started.

How the Implementation Process Works at BAFS

- Meet with a dedicated Solutions Consultant: First, you will speak with a dedicated BAFS Solutions Consultant who will assess your institution’s needs during a discovery call. After your institution’s business needs are determined, our Solutions Consultant will create a proposal. Once the proposal has been approved, our consultant will then provide you with an overview of how our process works, including the onboarding and training process.

- Start the onboarding process: Our dedicated Onboarding team provides each BAFS client with a seamless and fast onboarding process.

- Training: Once the onboarding process has been completed, training will commence! BAFS is proud to offer a training curriculum that will be customized to your institution’s needs.

- Continued support: Our dedicated Client Experience Team will provide ongoing and continuous support throughout your time with BAFS. They are available to answer any questions that you may have.

Future Trends in Loan Management

Predictions for the Lending Industry

- Bank technology investments will continue to be on the rise.

- Customer expectations for improved digital expectations will increase. In fact, “Three-quarters of banks say it’s more challenging to win and retain customers than it was a year ago” (Wolters Kluwer, 2023).

- There will be continued economic uncertainty with rising interest rates and varying inflationary trends.

Conclusion

Recap of Key Benefits

In conclusion, effective loan management software will streamline the loan application process, reduce risk, provide automation, and be cost-effective for banks and credit unions.

Final Thoughts on Optimizing Lending Operations

It can be difficult to determine which commercial lending software is right for you. Not only are you implementing software, but you’re also partnering with a company that will provide the software, which can make or break your experience.

The BAFS Difference

Our software: Our proprietary commercial lending software, BLAST®, was created in-house — by bankers, for bankers. We’ve spent 10 years developing our software so that it best serves our clients’ needs.

Our people: The BAFS team is our greatest resource. With decades of combined commercial lending experience at your disposal, our team of experts will augment your staff to create a true Commercial Loan Department within your organization, providing the customization you need. Our dedicated Client Experience Team will act as an extension of your team with the goal of growing your business so that your institution becomes a leader in the commercial lending space.

FAQs

What is the first step in selecting a loan management system?

The first step in selecting a loan management system is to schedule a discovery call with the company that you’re interested in working with. They will be able to assess your needs and create a tailored proposal. Interested in taking that step? Contact our team today.

How can BAFS’ loan management software, BLAST®, help my institution align with regulatory changes?

BAFS’ proprietary software, BLAST®, has reporting capabilities that will help your institution align with compliance and regulatory requirements.

Commercial Lending, Done Your Way

If you’re interested in learning more about BAFS’ commercial lending software and/or services, contact us today.