BAFS Announces the Launch of its Borrower Portal

The Borrower Portal is a self-service tool that streamlines the commercial lending process

MONROE, La., February 6th, 2024 – BAFS (Business Alliance Financial Services) announced today the launch of its Borrower Portal – a commercial lending platform designed to link commercial lenders directly to borrowers.

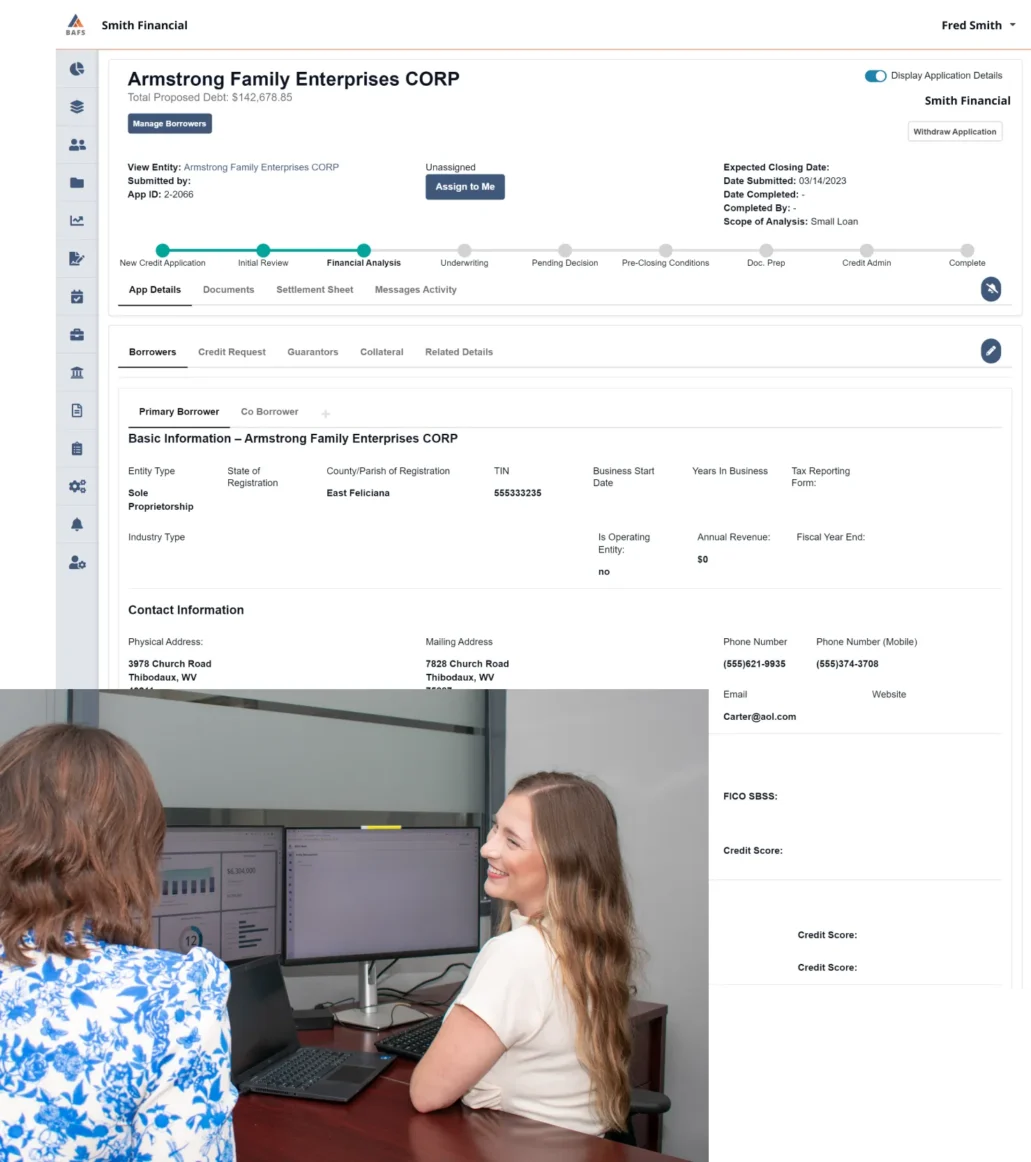

White-labeled with the lending institution’s branding, BAFS’ Borrower Portal allows borrowers to input loan request information, upload documents, and submit loan applications. Borrowers are guided through each step of the loan application as they provide information and upload documents. The loan application flow is intuitive and efficient, shortening the time needed to complete the loan process.

All information, including documents, gets transferred directly to the lender in BAFS’ proprietary BLAST® platform. All data is securely stored and uploaded to BLAST®, allowing the loan application to be viewed and processed using already-established processes and procedures. The lender has complete insight into all steps of the process and anything that may be missing can be identified quickly, saving time and increasing efficiency.

“We are so proud to be launching the BAFS Borrower Portal,” said Ricky Guillot, CEO at BAFS. “ This technology provides lenders with streamlined efficiency and borrowers with simplicity. It’s a win-win for both parties.”

“The BAFS team checks the two most important boxes for me,” said President and CEO of Citizens Bank & Trust, Brooks Lewis. “They are great at their jobs, and they are great people. That is a winning combination every time.”

Features of the Borrower Portal:

- The Borrower Portal syncs directly with BLAST®, giving borrowers insight into the status of their loan.

- The portal is white-labeled to a lender’s branding to present the portal as theirs.

- Information and documents are shared between the Borrower Portal and BLAST®, eliminating the need for the same information to be entered by the borrower and lender.

- Self-service profile and password management for Borrower Portal users.

What is BLAST®?

BLAST® is BAFS’ cloud-based, proprietary software that directs financial institutions’ workflows, guiding the path of a loan from application and analysis, through underwriting, documentation prep, and credit administration.

Read the official release here.

About BAFS

BAFS provides financial institutions with commercial lending software and services. This approach enables customized solutions to unique problems.

For more information, visit www.bafs.com and follow us on LinkedIn.

Media Contact

Zoe Turnbull | Zoe.Turnbull@BAFS.com

Related Resources

Our unique combination of people and platform make us the leaders in commercial lending management. See what our experts are doing today to help our partners succeed tomorrow and into the future.

View BLAST® in Action

Our BLAST®-enabled suite of services offers a comprehensive solution for loan management and credit administration across application, analysis, underwriting, and document preparation. Schedule a demo with our team and see how our coordination of people and platform will grow your business!