Commercial Lending: 8 Things to Know for the Remainder of 2024

As we move into the second half of 2024, financial institutions may be curious about how the commercial lending landscape will pan out for the rest of the year.

Below, we highlight what the commercial lending landscape may have in store so that your institution can be better prepared:

1. Loan Demand Will Remain Weak in 2024

Due to the rising rate environment and a weak dollar, loan demand is expected to remain slow for the rest of 2024. Therefore, financial institutions will have to hustle to obtain quality loans.

2. Examiners Will Have Specific Focal Points

As marginal loans begin to deteriorate, examiners will be focusing on underwriting, quality, servicing, and loan reviews. As a result, financial institutions should tighten up underwriting standards to prepare for examiners.

3. There Will Be Continued Emphasis on Minimizing Risk

Safety and soundness will be a priority and examiners will criticize financial institutions that took on extreme risk. It will be important for institutions that fall into this category to prepare a plan that reduces risk over the coming months and years.

4. Liquidity Will Remain a Focus

Liquidity will continue to be a focal point because of squeezed margins created by the rising rate environment. Therefore, financial institutions will focus on selecting the highest quality of loans to ensure they have adequate liquidity to fund. Some institutions are already relying on Federal Reserve and FHLB lines to survive.

5. Financial Institutions Will Generally Not Be Replacing Loan Officers and Loan Production Staff

As attrition occurs, financial institutions will wait for a more stabilized economy and increased loan demand before adding back employees.

6. The Stressed CRE Market Will Result in More Diligent Monitoring

The stressed CRE market will create the necessity for financial institutions to watch their portfolios closely and attempt to identify problem loans before significant delinquency occurs. Loan workouts and maintaining close relationships with borrowers will be imperative.

7. Section 1071 of the Dodd-Frank Act Will More Than Likely Come Back Around (But In a Different Format)

Section 1071 of the Dodd-Frank Act will more than likely come back around (but in a little bit of a different format) and be approved without significant changes to the original plan. The LBA, Federal Reserve, and ICBA have all indicated this will be the end result.

What is section 1071 of the Dodd-Frank Act?

According to the Consumer Financial Protection Bureau, “In the Dodd-Frank Wall Street Reform and Consumer Protection Act, Congress directed the Bureau to adopt regulations governing the collection of small business lending data. Section 1071 of the Dodd-Frank Act amended the Equal Credit Opportunity Act (ECOA) to require financial institutions to compile, maintain, and submit to the Bureau certain data on applications for credit for women-owned, minority-owned, and small businesses.

Congress enacted section 1071 for the purpose of:

- Facilitating enforcement of fair lending laws

- Enabling communities, governmental entities, and creditors to identify business and community development needs and opportunities for women-owned, minority-owned, and small businesses” (Consumer Financial Protection Bureau, 2024).

What Are the Compliance Deadlines for Section 1071 of the Dodd-Frank Act?

The compliance deadline has been extended for the small business lending rule. You can find the specific deadlines below:

8. Financial Institutions Will Want Increased Efficiency

Financial Institutions will look for ways to increase efficiency in staff and technology to decrease costs and enhance any potential profits.

How Can My Financial Institution Increase Efficiency?

Your institution has unique commercial lending needs, and BAFS can help you identify and address those needs.

BAFS provides financial institutions with commercial lending software and services that are fully customized to you, enhancing your loan portfolio and increasing efficiency.

Whether you require commercial lending software that manages the entire loan process, a team of experts who can handle commercial lending services, or a combination of both, BAFS will meet you where you are to grow your business.

About BAFS

Our People

With decades of combined commercial lending experience, our team of experts will augment your staff, putting a true end-to-end commercial lending department at your disposal.

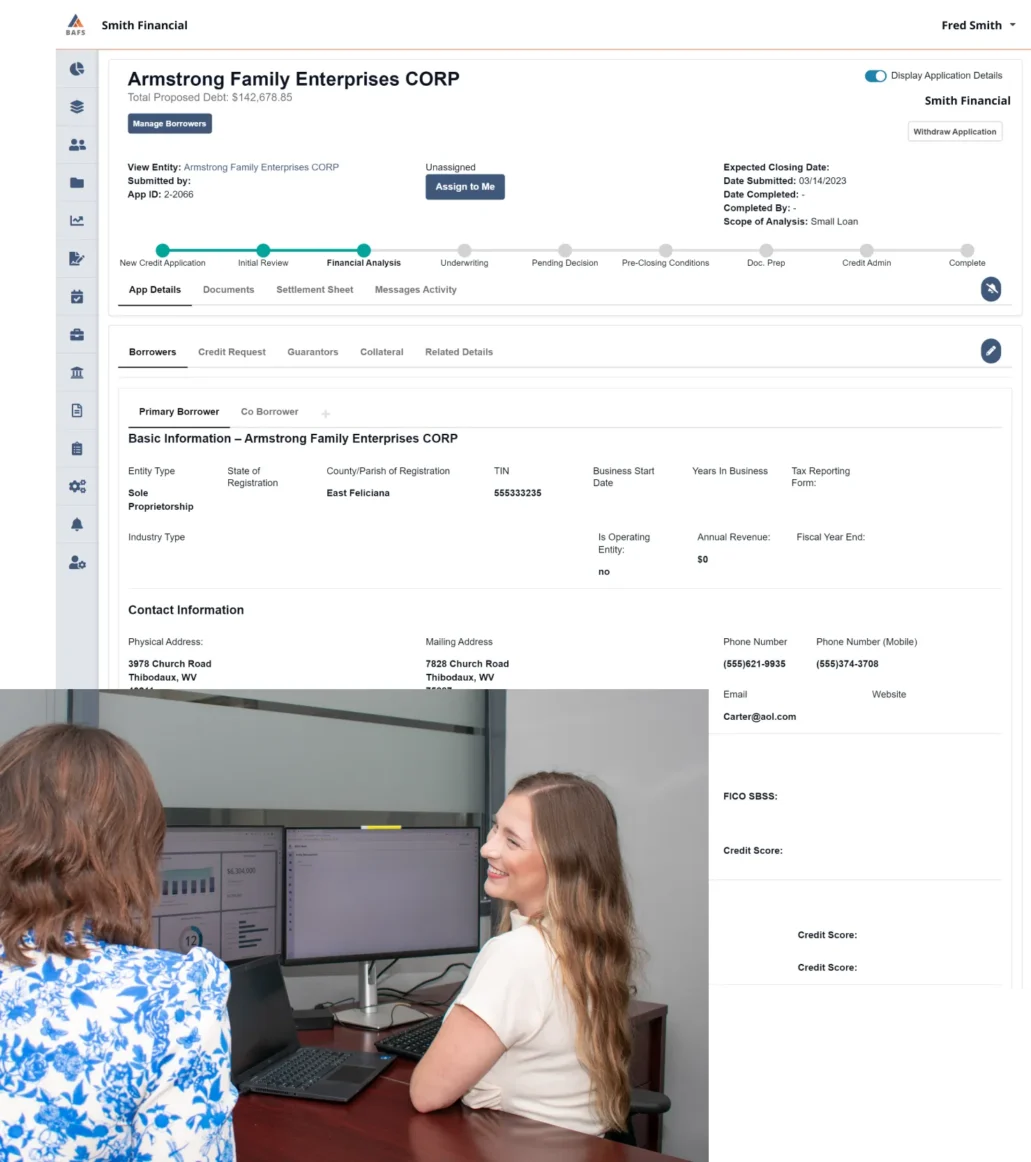

Our Platform

The BLAST® Commercial Lending and Administration Platform is designed specifically to empower our partner financial institutions’ growth through improved efficiency, compliance, and customer relationship management.

Our Purpose

BAFS serves our clients every day, unlocking growth and opportunity by providing solutions they need, when and how they need them.

Get Started With BAFS

Learn about our packages and the commercial lending services we offer here. To learn more, contact us today.

Commercial Lending, Done Your Way

If you’re interested in learning more about BAFS’ commercial lending software and/or services, contact us today.