BAFS Announces Market Expansion

Now Providing an Industry-First Combination of Commercial Lending Technology and Services to Financial Institutions

BAFS now serves as a single source for commercial lending needs nationwide

MONROE, LA., June 6th, 2023 – BAFS (Business Alliance Financial Services) announced today its market expansion that will give financial institutions access to both commercial lending software and services nationwide – an industry-first combination.

Founded in 2009, BAFS has served as the commercial lending back-office for financial institutions, providing services such as loan origination, underwriting, loan reviews, and more. Now, financial institutions will also be able to utilize BAFS’ proprietary cloud-based lending platform, BLAST®.

BLAST® was developed in 2014 to support client loan servicing. Platform capabilities have since been expanded for direct client use, giving BAFS’ clients the flexibility to choose between BAFS’ software, services, or a combination of both.

“We are elated to expand our company solutions and serve as a single source for all commercial lending needs,” said Richard Guillot, CEO at BAFS. “Each financial institution has its unique challenges, making solution flexibility essential for growth. We pride ourselves on providing the best of commercial lending software and services with unmatched customer service and care.”

“Our partnership with BAFS has given us greater insight into our commercial lending program,” said Layne Weeks, EVP/CCO of Century Next Bank. “Their level of expertise, timeliness with onboarding, and ability to produce results is remarkable. Our relationship with BAFS has also produced favorable comments from our regulators.”

What is BLAST®?

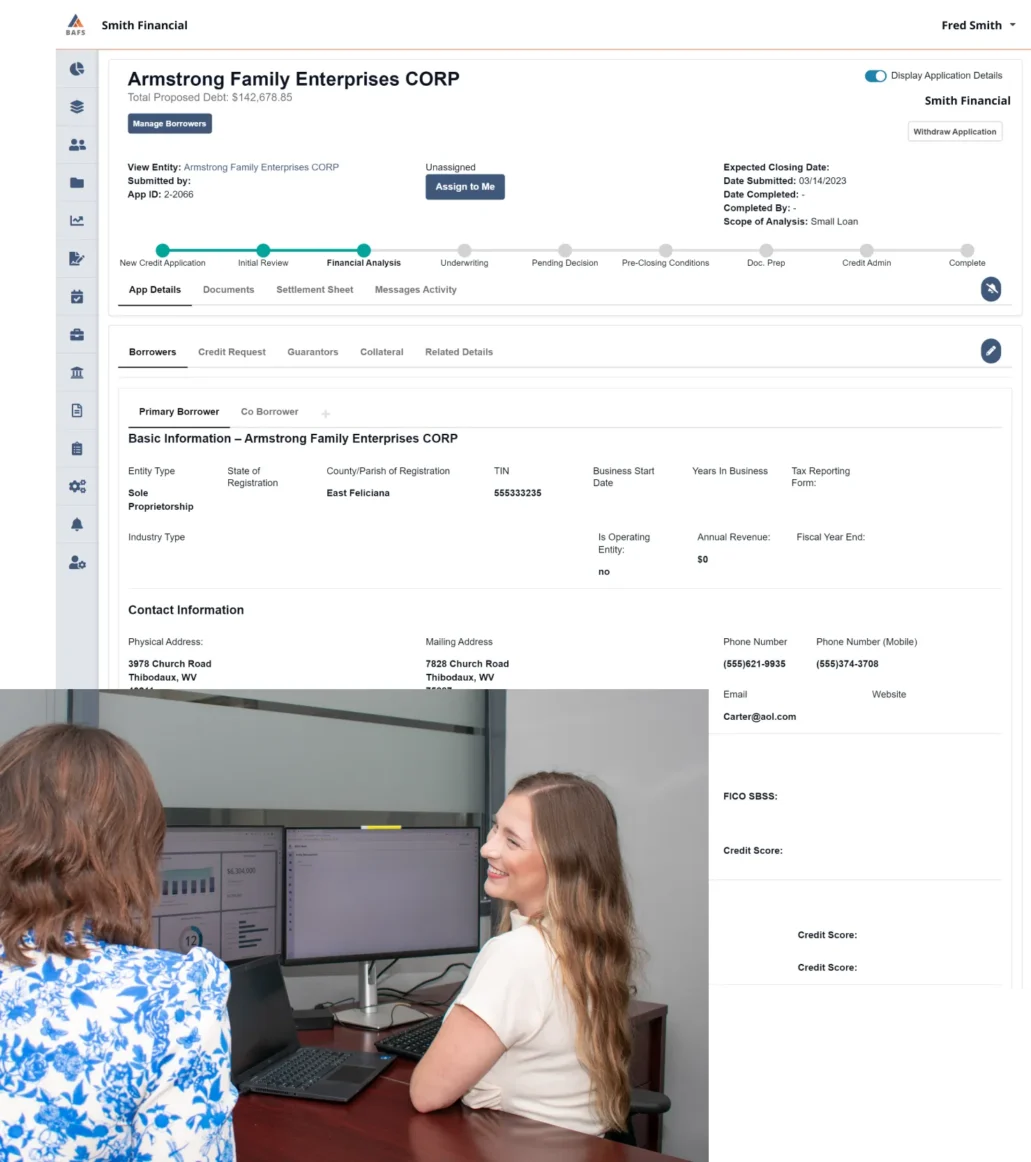

BLAST® is BAFS’ cloud-based, proprietary platform that directs financial institutions’ workflow, guiding the path of a loan from application and analysis, through underwriting, documentation prep, and credit administration.

BLAST® features include:

-

- Financial spreads modeling with OCR efficiency

Credit memo modeling

- User dashboards

- Entity management

- Full LOS workflow

- Document administration

- Tickler and exception management

- Collateral and asset management

- Reporting and analytics output

- Loan review workflow

Additional Features that BAFS Provides:

Presented with a financial institution’s company branding, the BAFS Borrower Portal simplifies the conversation between a financial institution and its potential and existing clients, enabling customers to upload documents and maintain direct contact throughout the lending process.

You can read the official release here.

About BAFS

BAFS (Business Alliance Financial Services) provides financial institutions with commercial lending services and technology – an industry-first combination. This approach enables customized solutions to unique problems.

For more information, visit www.bafs.com and follow us on LinkedIn and Twitter.

Media Contact

Zoe Turnbull | Zoe.Turnbull@BAFS.com

Related Resources

Our unique combination of people and platform make us the leaders in commercial lending management. See what our experts are doing today to help our partners succeed tomorrow and into the future.

View BLAST® in Action

Our BLAST®-enabled suite of services offers a comprehensive solution for loan management and credit administration across application, analysis, underwriting, and document preparation. Schedule a demo with our team and see how our coordination of people and platform will grow your business!