The BAFS Internship Program

What is the BAFS Internship Program?

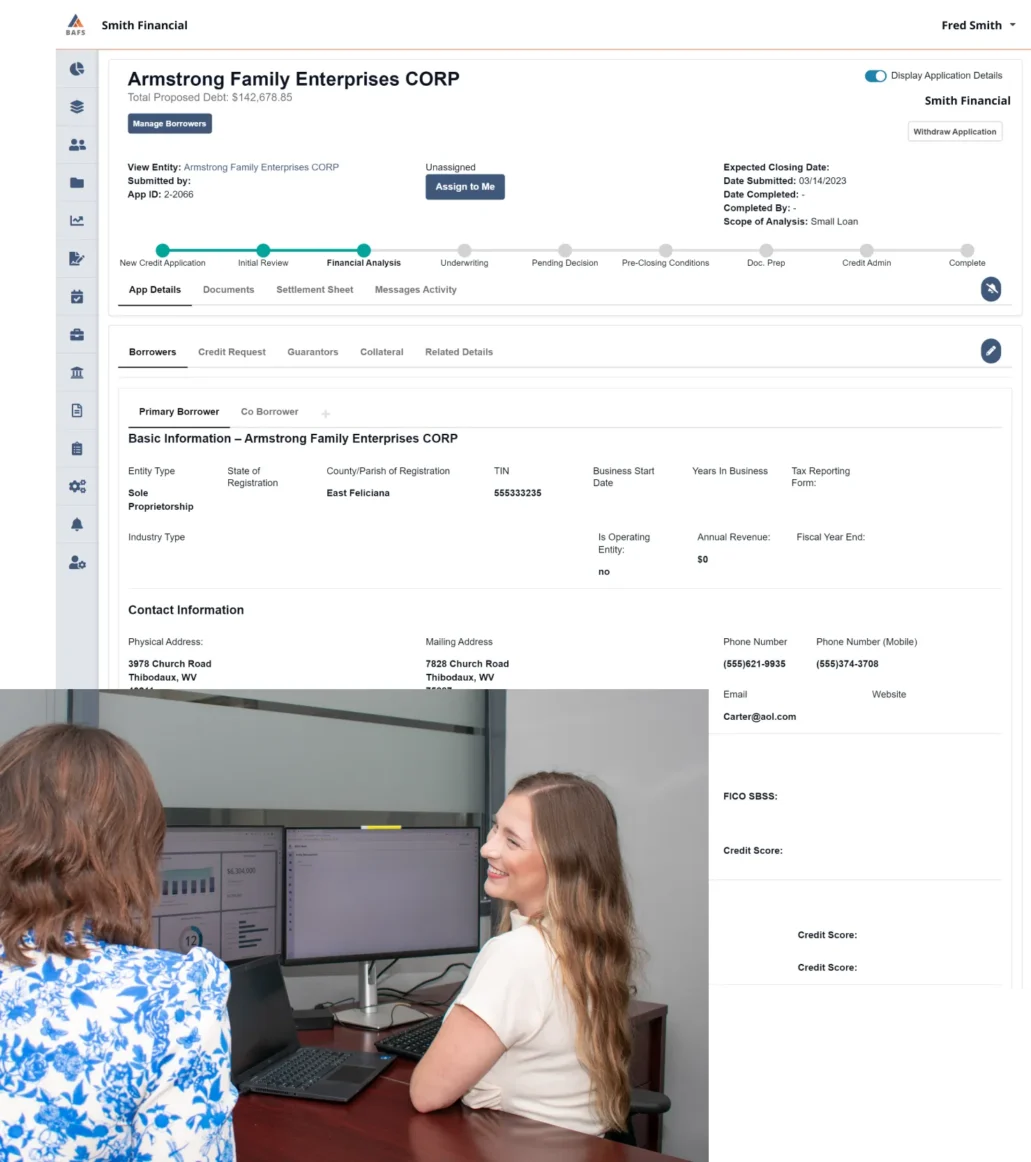

The BAFS Internship Program allows interns to gain hands-on experience in the FinTech/Commercial Lending field and the chance to improve their soft skills through various professional development opportunities. Each intern has a mentor or mentors within their respective departments.

When is the BAFS Internship Program held?

The internship program begins in the summer and takes place for 9.5 weeks. The summer internship is used as a discovery period for both BAFS and interns. At the end of the internship, a few interns will have the opportunity to continue their internships throughout the school year. Interns have the ability to create their own schedules to work around their classes and other commitments.

What internship opportunities are available?

BAFS offers internships in a number of areas including Financial Analysis, Data Analytics, Marketing, Desktop Support, and Client Experience.

What is a BAFS intern responsible for?

The intern is responsible for providing support to the various departments within the company daily with special tasks and projects. Each employee is responsible and accountable for demonstrating a commitment to the company’s mission statement, understanding that all divisions of the company work together for one common purpose — to delight our customers with the exceptional ease of doing business with BAFS.

When did the program start?

The Summer Internship Program officially began in May of 2022.

Have you partnered with any higher education institutions?

Yes, we are proud to have partnered with Louisiana Tech University and the University of Louisiana at Monroe for our internship program.

Where is the internship program held?

We have two locations where our internships are held — Monroe, LA at the BAFS headquarters and our Ruston, LA office at Louisiana Tech University at Tech Pointe.

Who manages the internship program and what does the process look like?

The BAFS Training and Development team oversees and manages the Internship Program.

What can a potential BAFS intern expect during the interview process?

The interview process typically consists of two separate interviews. The first interview is intended to be used as a time for the BAFS team and the applicant to learn more about each other and to share more about the overall internship program structure. This is also an opportunity for the training team to find the best fit for the potential intern. A second interview is held to provide more details about the specific intern role and expectations as well as answer questions.

Where can I apply for the BAFS Internship Program?

Students may apply using our online application or they may contact the Training and Development team at BAFS (traininganddevelopment@bafs.com).

What Our Interns Have to Say

“I was a Credit Analyst intern for the Lending department in the summers of 2020 and 2021. I was able to continue working as an intern throughout my senior year of college until I joined as a full-time analyst after graduation in May 2022. My experience as an intern was exceptional. I was able to learn many things at BAFS that will never be taught in school. I also had the opportunity as an intern to work on many complex loans, which better prepared me for the full-time analyst position. I am grateful for the internship program because it propelled me to the position that I hold today as the Client Design Manager. The foundation of knowledge that I learned as an intern still plays a huge part in my role now. I enjoy working for BAFS because of the relationships that I get to build with coworkers and clients. The family-like culture here is top-notch. As our company continues to grow and expand into new markets, now is the time to join our team.” — Joey Kirkland, Client Design Manager