Give your team the tools they need to deliver first-rate experiences to your clients. BAFS’ Essential suite provides access to a best-in-class, proprietary commercial lending platform that makes it easy for your back-office teams to manage their costs and improve efficiency across loan administration.

The Essential Package

Technology You

Need, When You Need It

You've got a commercial lending team in place, but you need technology. Empower your financial institution with our proprietary, cloud-based lending software to fuel your growth and boost profitability.

BLAST® Lending Suite

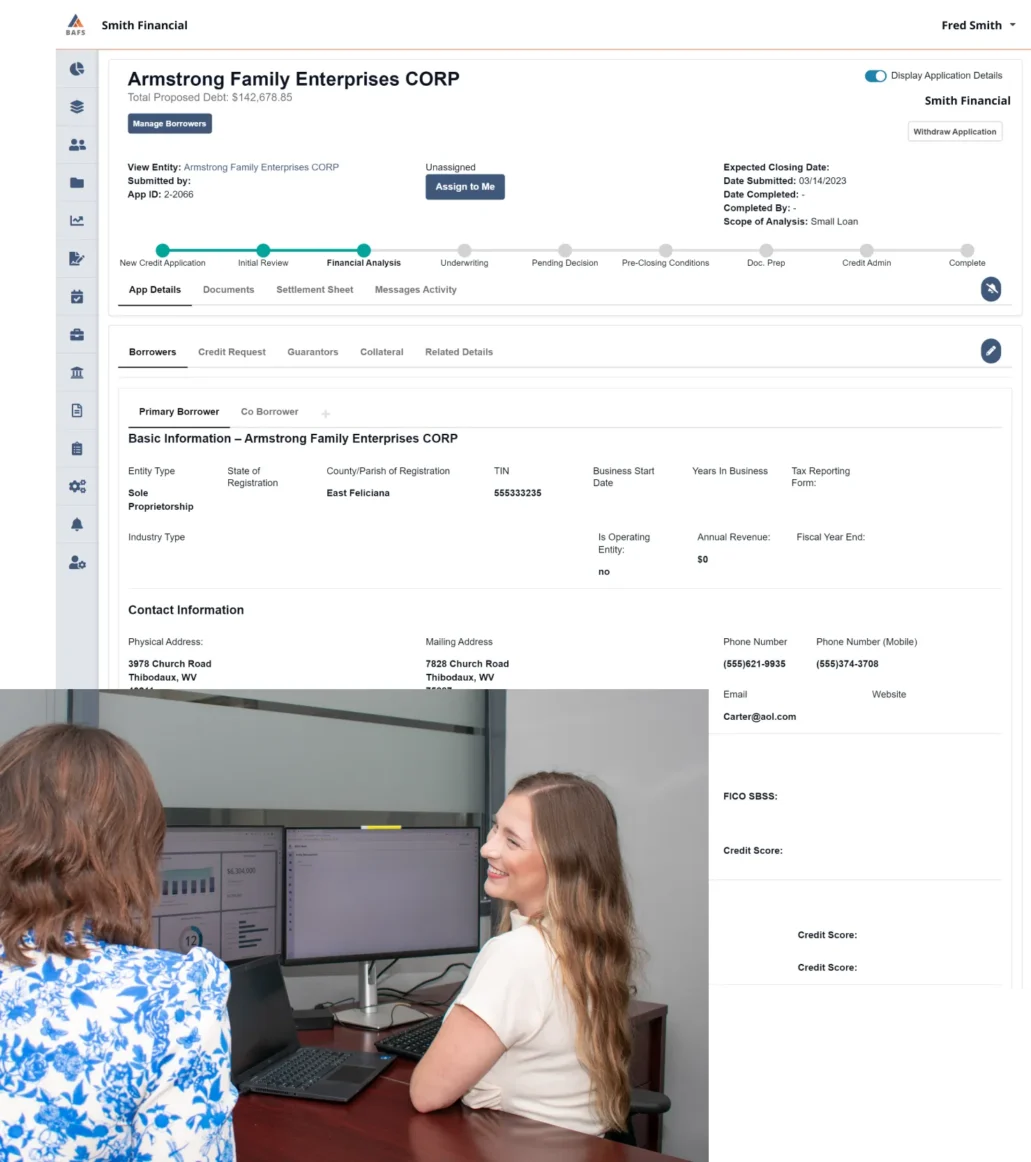

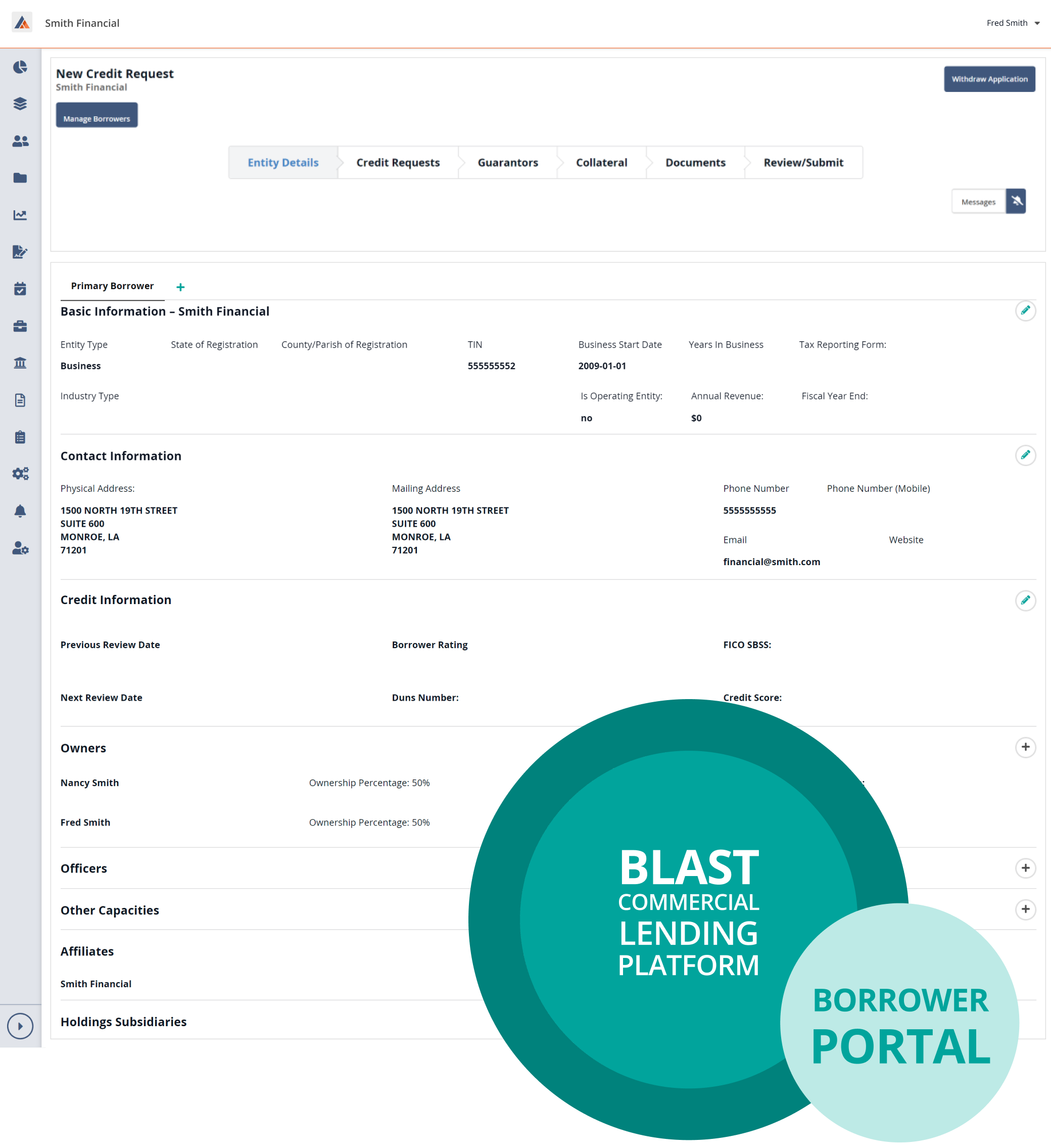

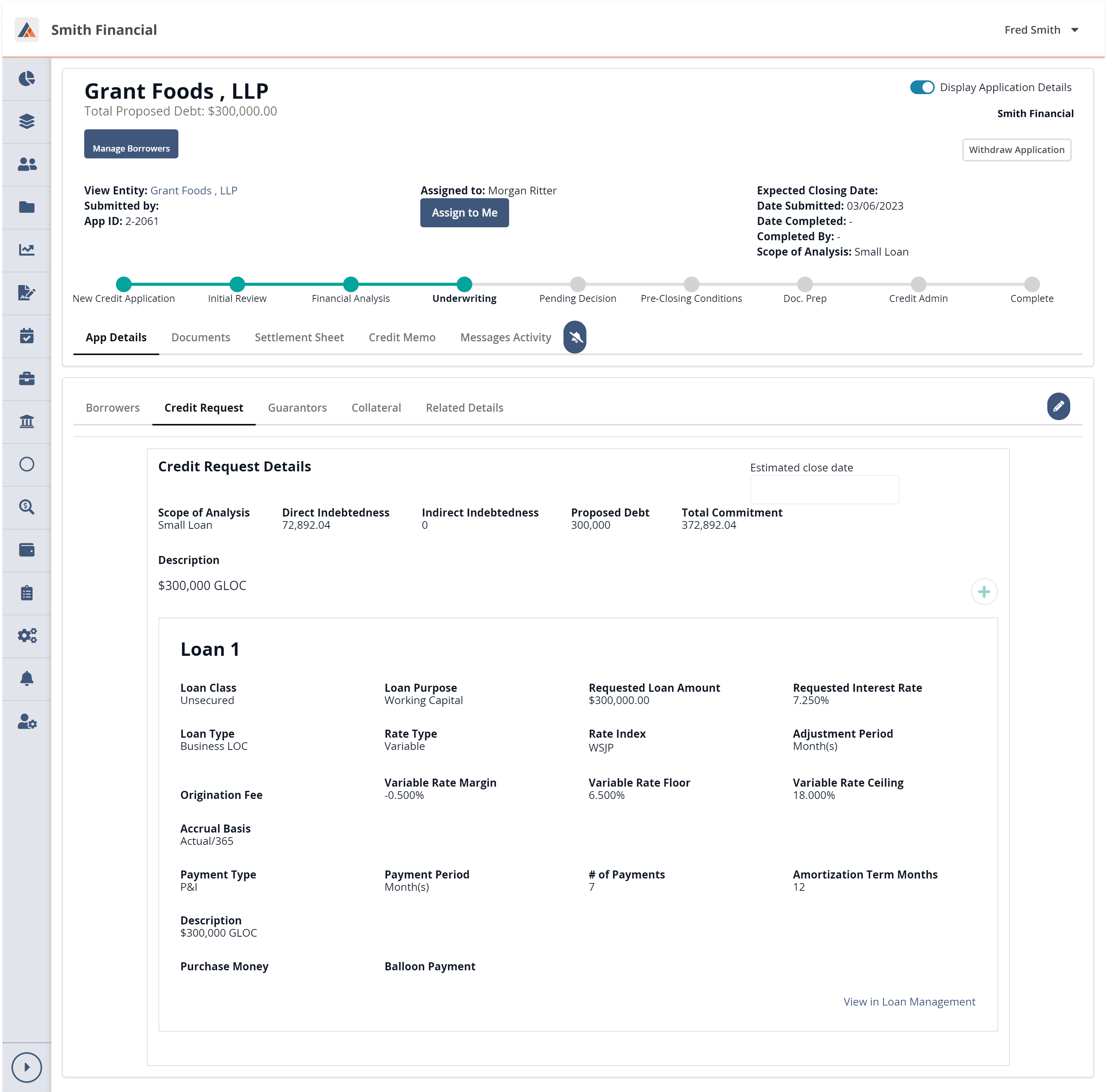

With the BLAST® Lending Suite, all aspects of commercial lending (including application, underwriting, document preparation, and closing) can be found in one guided workflow. The BLAST® Lending Suite enables you and your team to be more accurate and efficient.

BLAST® Credit Admin Suite

The BLAST® Credit Admin Suite provides your post-closing teams the best resource on the market to guide their policy, analytics, document administration, collateral management, and loan review workflow in one easy to use source!

Expand Your Team's Capabilities

With BLAST®-Enabled Tools

Enable New Services

Streamline loan administration with dedicated tools for credit administration, loan management, and more.

Boost Efficiency

Our proprietary software was built from the ground-up to support loan professionals with user-friendly tools and customized workflows that increase loan management efficiency.

Seamless Data Integration

Transfer all data effortlessly into BLAST® and hit the ground running with minimal downtime or onboarding delays.

Accelerate Loan Administration Goals

Our BLAST® platform was built to provide greater efficiency, productivity, and accuracy for financial institutions. The platform’s advanced features allow your organization to do more with less, expanding your loan processing capabilities and helping you generate more revenue overall.

Maintain Security and Compliance

As your primary platform for commercial loan management, you can rest easy knowing that BLAST® was designed to protect client data across cybersecurity and compliance with all applicable regulatory bodies and requirements.

FAQ - The Essential Package

If all your financial resources are available, this process can be completed within 1 to 2 weeks.

Our BLAST® software was created by financial experts for financial providers. This software was created by BAFS for BAFS clients.

Our BLAST® software will handle daily inputs from your existing core banking system without the need for system conversion or change. This allows the data that is used by BLAST® to be fed from your existing core banking system and used for future commercial loan applications.

Our BLAST® platform is purpose-built by BAFS’ engineering team specifically to meet the needs of our lending partners. It is secured on Amazon Web Services (AWS) which allows BAFS to be more agile in our utilization of hosting environments, further enhance our security posture, and reduce the likelihood of outages due to a single location datacenter.

The BLAST® platform is both SOC 1 Type II and SOC 2 Type II certified. We have a rigorous Enterprise Risk Management process that includes both a Business Continuity & Disaster Recovery Plan and an extensive change management process.

The BLAST® Product team is constantly updating the platform to make our partners more efficient and effective. As new features and enhancements are added and training is needed, the BAFS Training and Education team will ensure your team’s understanding and readiness.

View BLAST® in Action

Our BLAST®-enabled suite of services offers a comprehensive solution for loan management and credit administration across application, analysis, underwriting, and document preparation. Schedule a demo with our team and see how our coordination of people and platform will grow your business!