BAFS Blueprint

How You Launch,

Scale & Succeed

Commercial lending is one of the strongest growth opportunities for community financial institutions — but most don’t have the internal infrastructure, staffing, or expertise to launch and scale confidently. The BAFS Blueprint changes that.

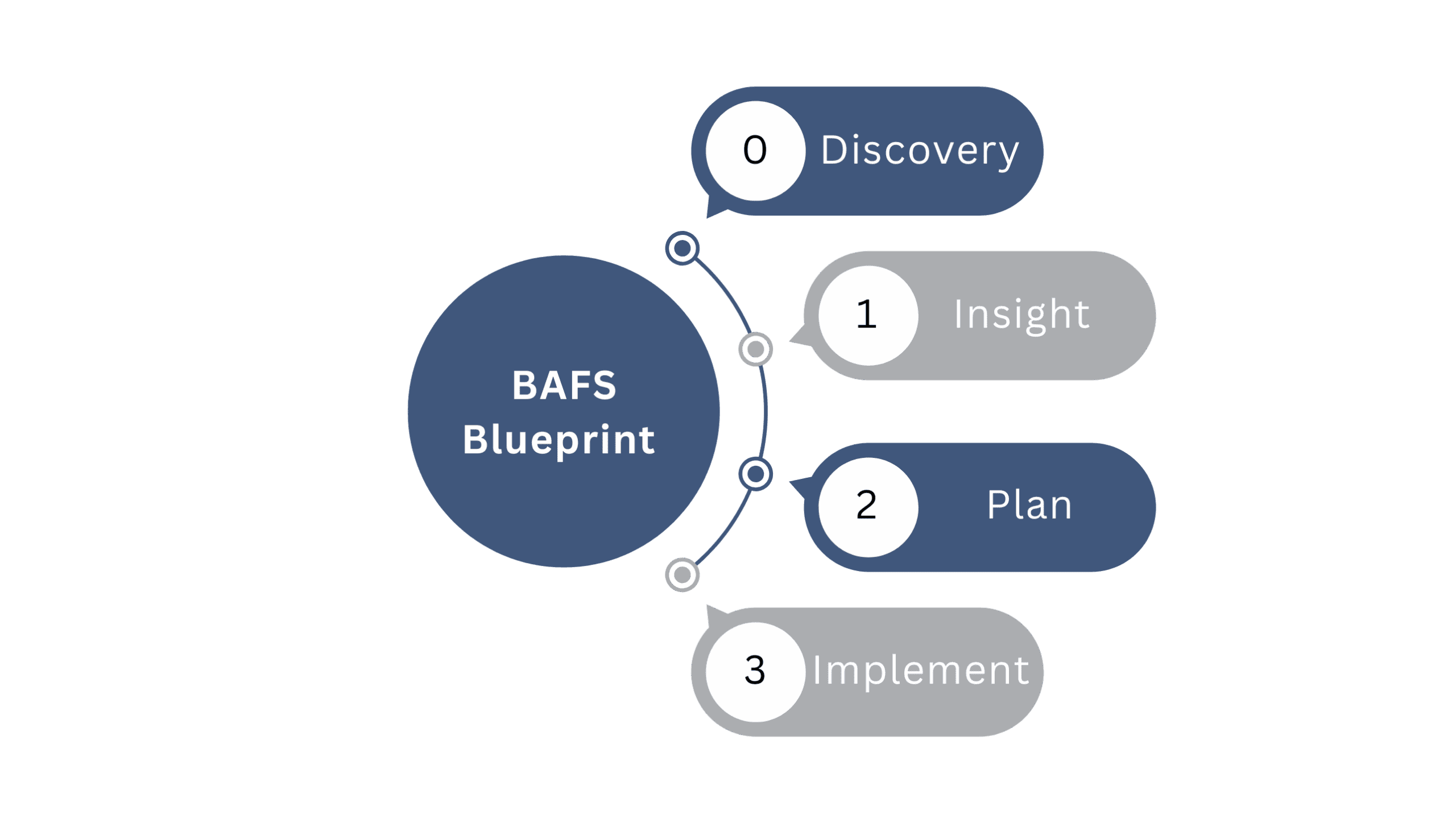

The Blueprint is a guided, four-phase framework that helps your institution design, implement, and grow a sustainable commercial program supported by real operators and industry-proven technology.

0. Discovery

Every Blueprint journey begins with a free, consultative discovery session led by BAFS commercial lending experts.

We work with your leadership team to:

-

Clarify strategic goals and growth objectives

-

Assess current systems, staffing, and capabilities

-

Identify gaps and opportunities using industry-based analysis

This phase ensures your institution starts with clarity and a realistic path forward.

1. Insight

Using your internal data and our market intelligence, we help you understand where commercial lending can drive the most meaningful impact.

Key deliverables include:

-

Market analysis: local business demand, trends, and risk indicators

-

Financial insights: capacity, performance metrics, risk tolerance

-

Operational needs assessment: people, processes, systems, and compliance readiness

-

Strategic assessment: a roadmap showing how commercial lending supports sustainable growth and deeper member relationships

This phase turns data into direction.

2. Planning

Once priorities and opportunities are clear, BAFS helps you build the full operational and strategic plan needed to launch effectively.

Your plan may include:

-

Target market segmentation

-

Value proposition and product detail

-

Go-to-market and growth strategy

-

Distribution and sales strategy

-

Resource allocation & budgeting

-

Governance and board training

-

Complete policy, procedure, and documentation development for business products

This is where strategy becomes structure.

3. Implementation

BAFS deploys your commercial lending program at the pace that fits your institution.

Implementation support includes:

-

Installation of your commercial lending plan

-

BLAST® platform customization and team training

-

Data integration with your core

-

Borrower portal activation

-

Access to the BAFS participation group

-

BAFS also provides turnkey operational services to accelerate launch and reduce internal lift.

Your team gains immediate capacity without adding headcount.

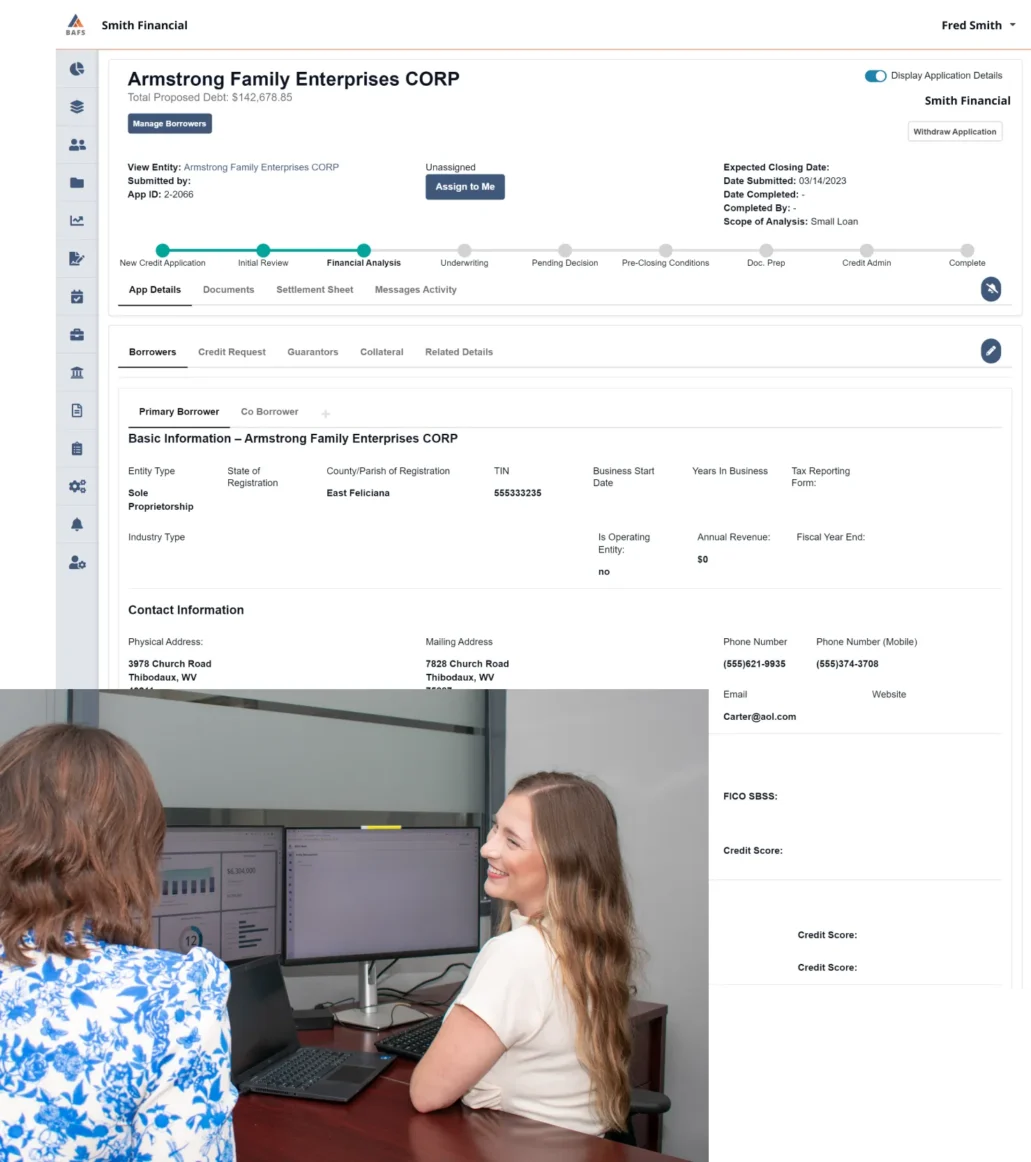

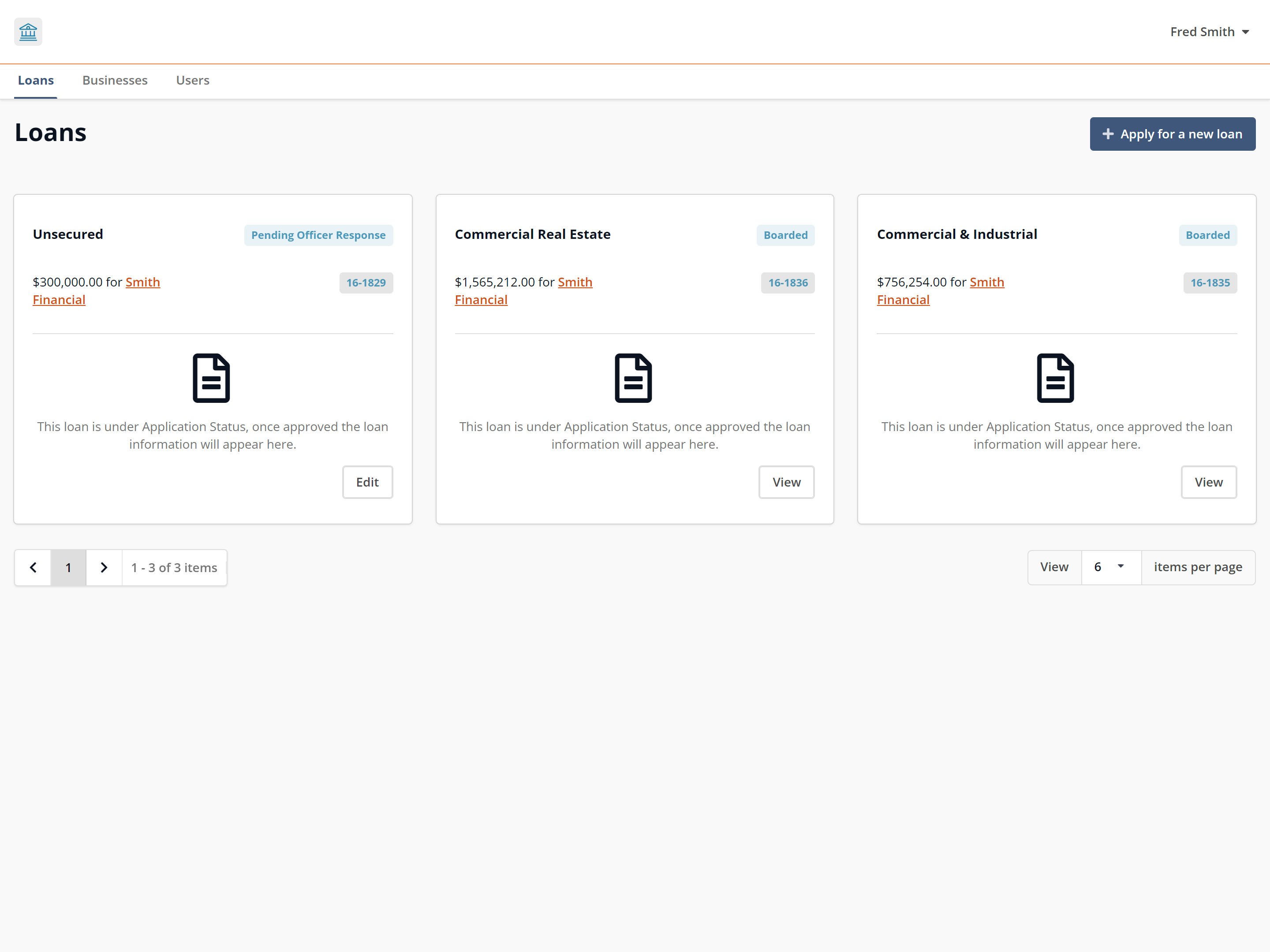

View BLAST® in Action

Our BLAST®-enabled suite of services offers a comprehensive solution for loan management and credit administration across application, analysis, underwriting, and document preparation. Schedule a demo with our team and see how our coordination of people and platform will grow your business!