We have spent years developing and honing the

cloud-based, BLAST® Commercial Lending and

Administration Platform with one goal in mind

— to provide you with the tools you need to be

more successful. Whether you need our BLAST®

Lending Suite, Credit Admin Suite, or both, you

will have the tools to do just that!

How We Do It

The BLAST® Platform

BLAST® Lending Suite

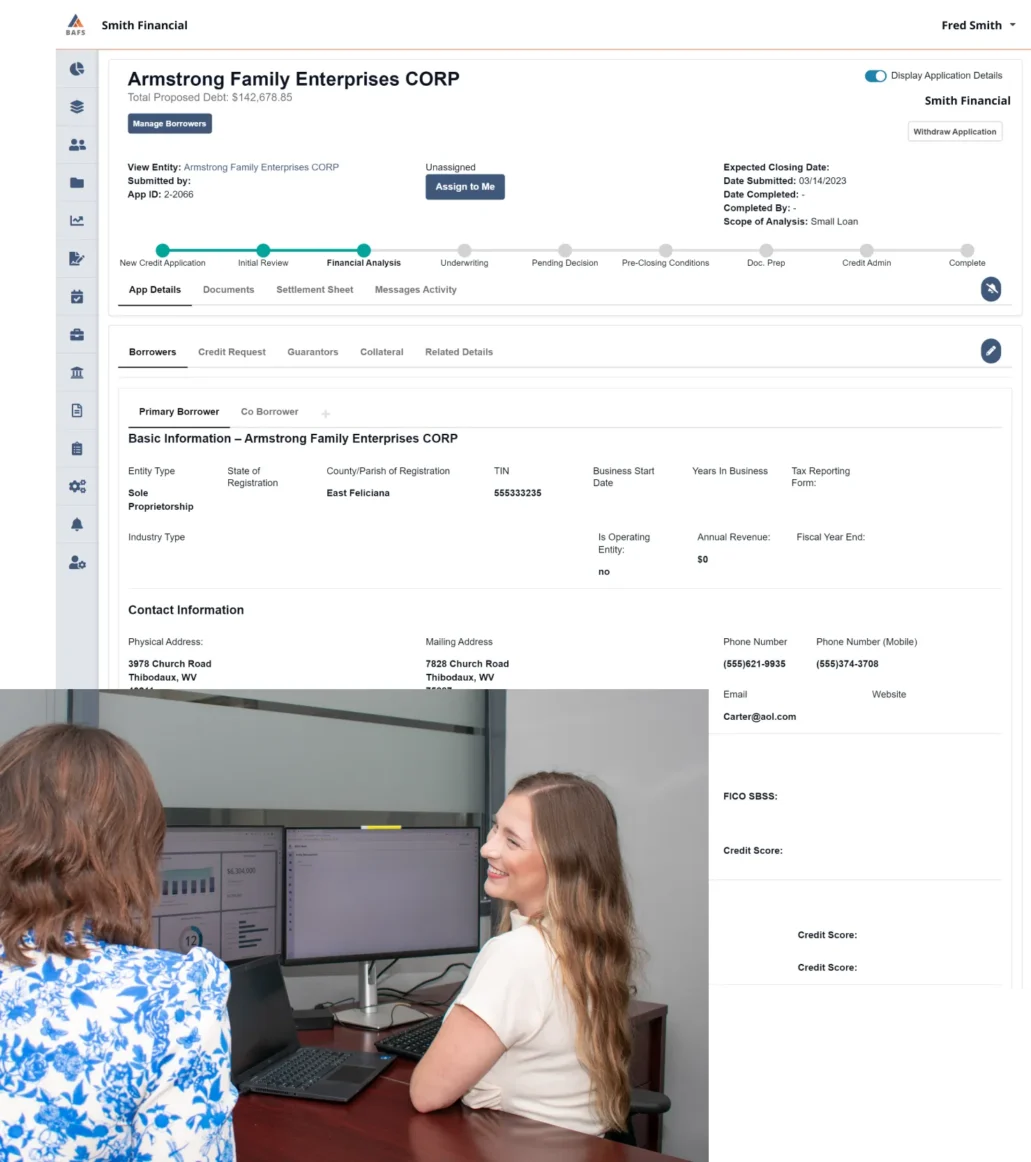

With the BLAST® Lending Suite, all aspects of commercial lending (including application, underwriting, document preparation, and closing) can be found in one guided workflow. The BLAST® Lending Suite enables you and your team to be more accurate and efficient.

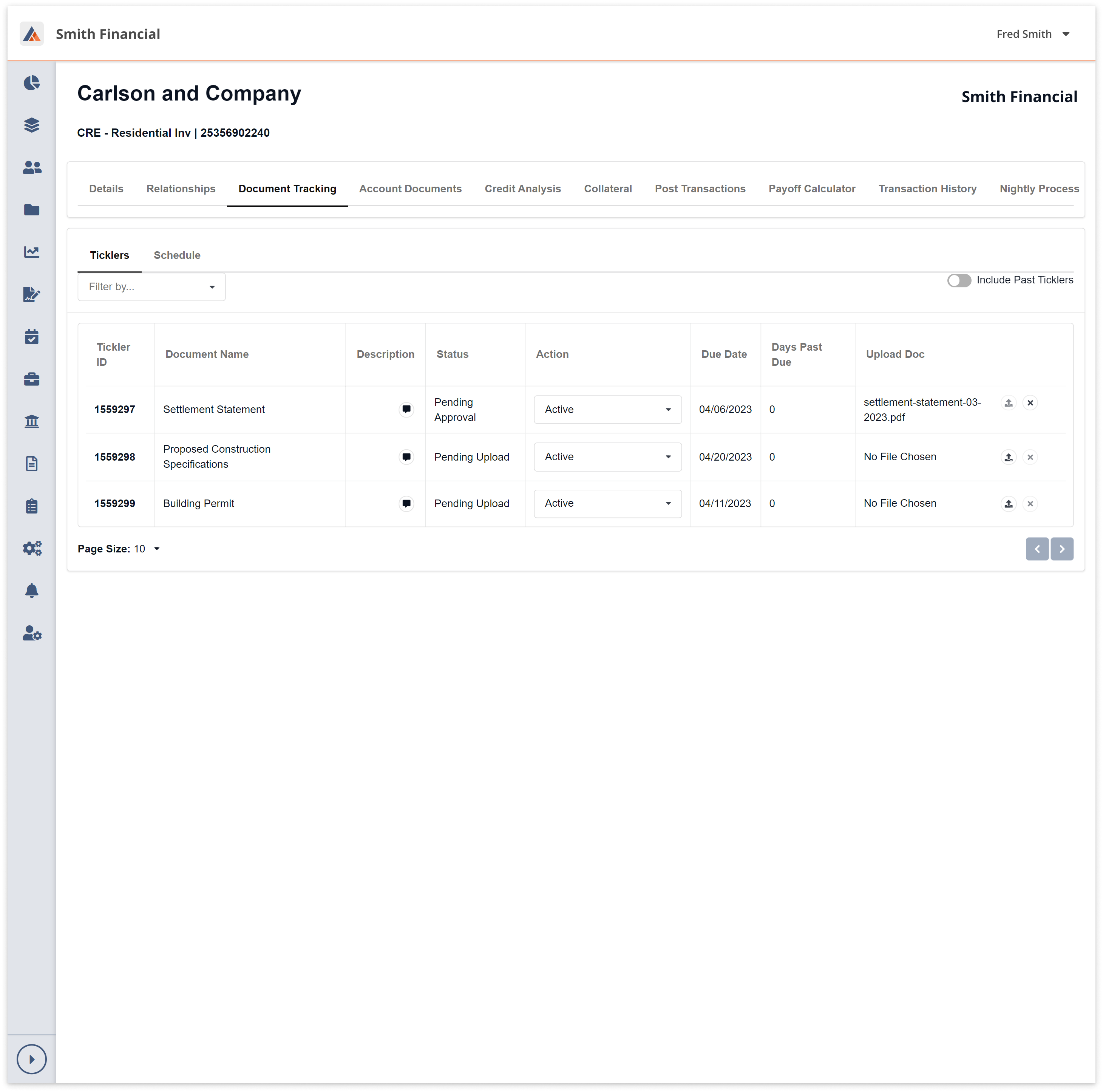

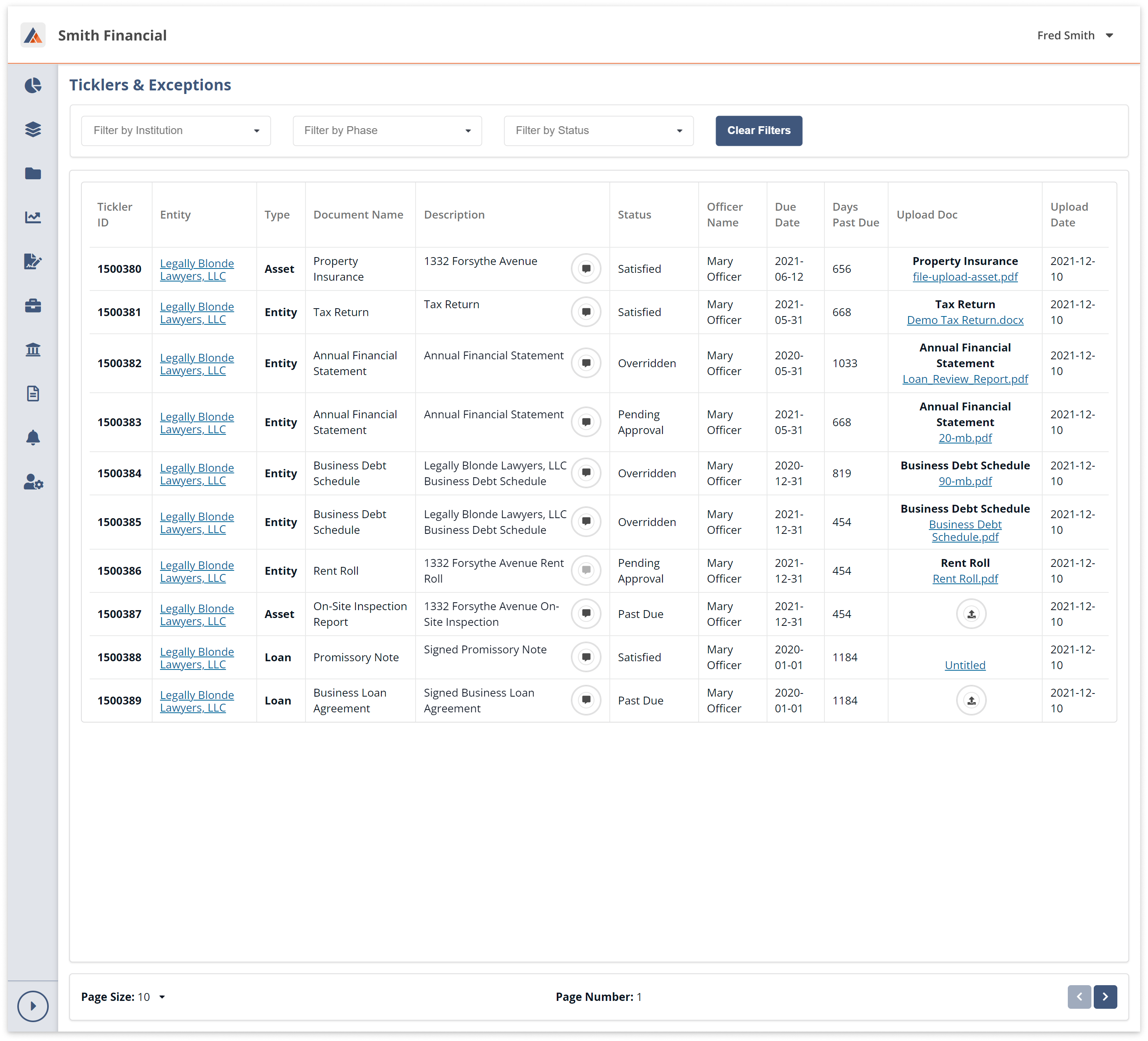

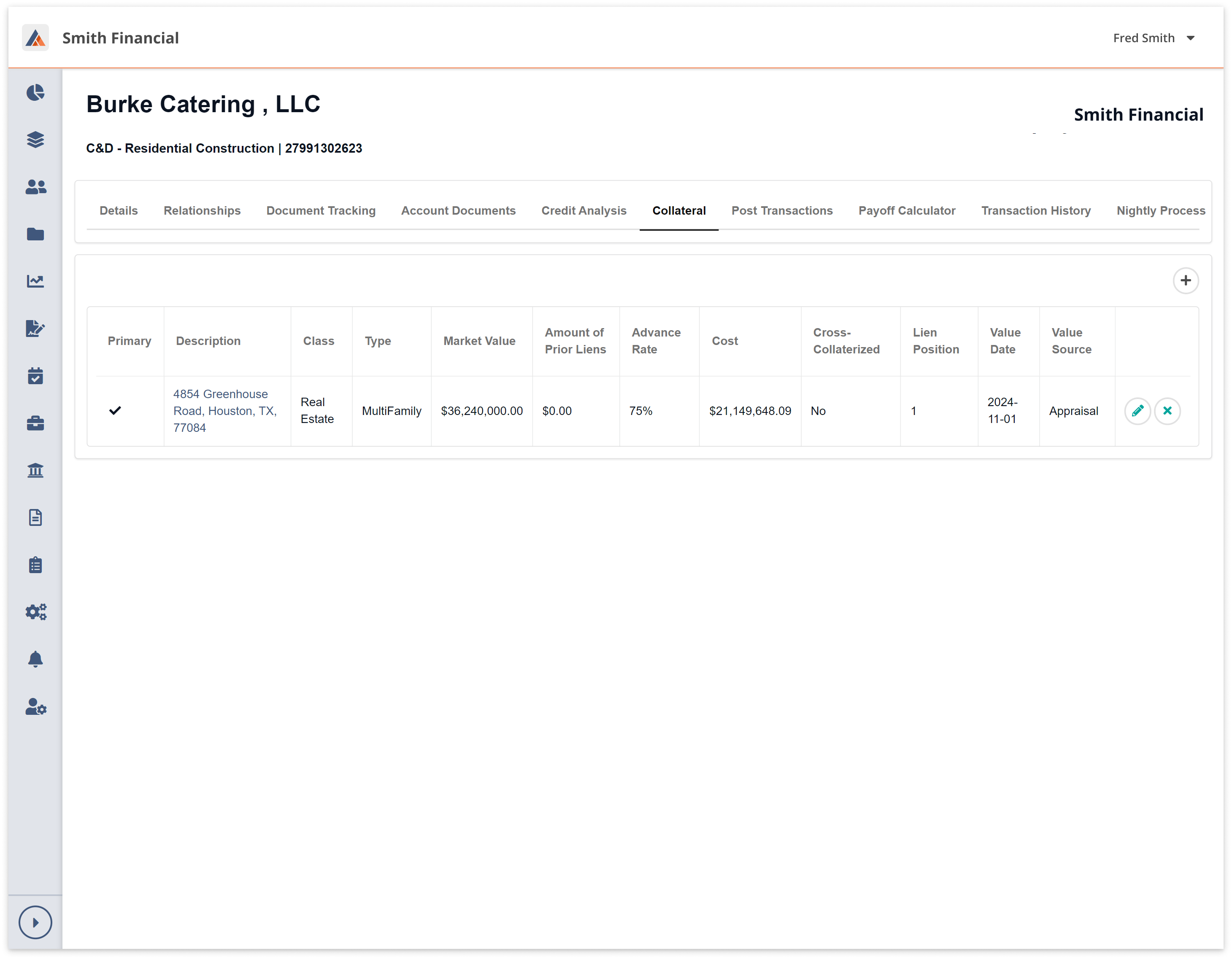

BLAST® Credit Admin Suite

The BLAST® Credit Admin Suite provides your post-closing teams with the best resource on the market to guide their policy, analytics, document administration, collateral management, and loan review workflow in one easy-to-use source!

With BLAST® Lending & Credit

Admin Combined, Your Team

Will Dominate the Market

The BLAST® Lending & Credit Admin Suites have been purpose-built by commercial lenders, for commercial lenders. Not just a BAFS logo printed on some technology we’ve purchased, BLAST® was designed specifically with your teams in mind. Our mission is to empower your teams through improved efficiency, compliance, and customer relationship management to fuel new growth and drive profitability.

We’ve packaged BLAST® to best suit your needs wherever you happen to be in your commercial lending journey. If you have a back office for lending but not credit admin functions, you can use BLAST® for that. If your needs are more on the post-closing side, we’ve got you covered. If your all-star team needs both, we have a path for you.

Our goal is to be where you need us to be!

BLAST® Lending

Paves the Way

Your client needs to fund a new commercial building or vehicle. Perhaps they want to start a whole new business. Once the Borrower Portal has collected all required customer information, BLAST® Lending will guide the loan over the goal line. Your team doesn’t need to think of the next step or wonder where they are in the process. They have everything in one location!

Mobile Tab Menu

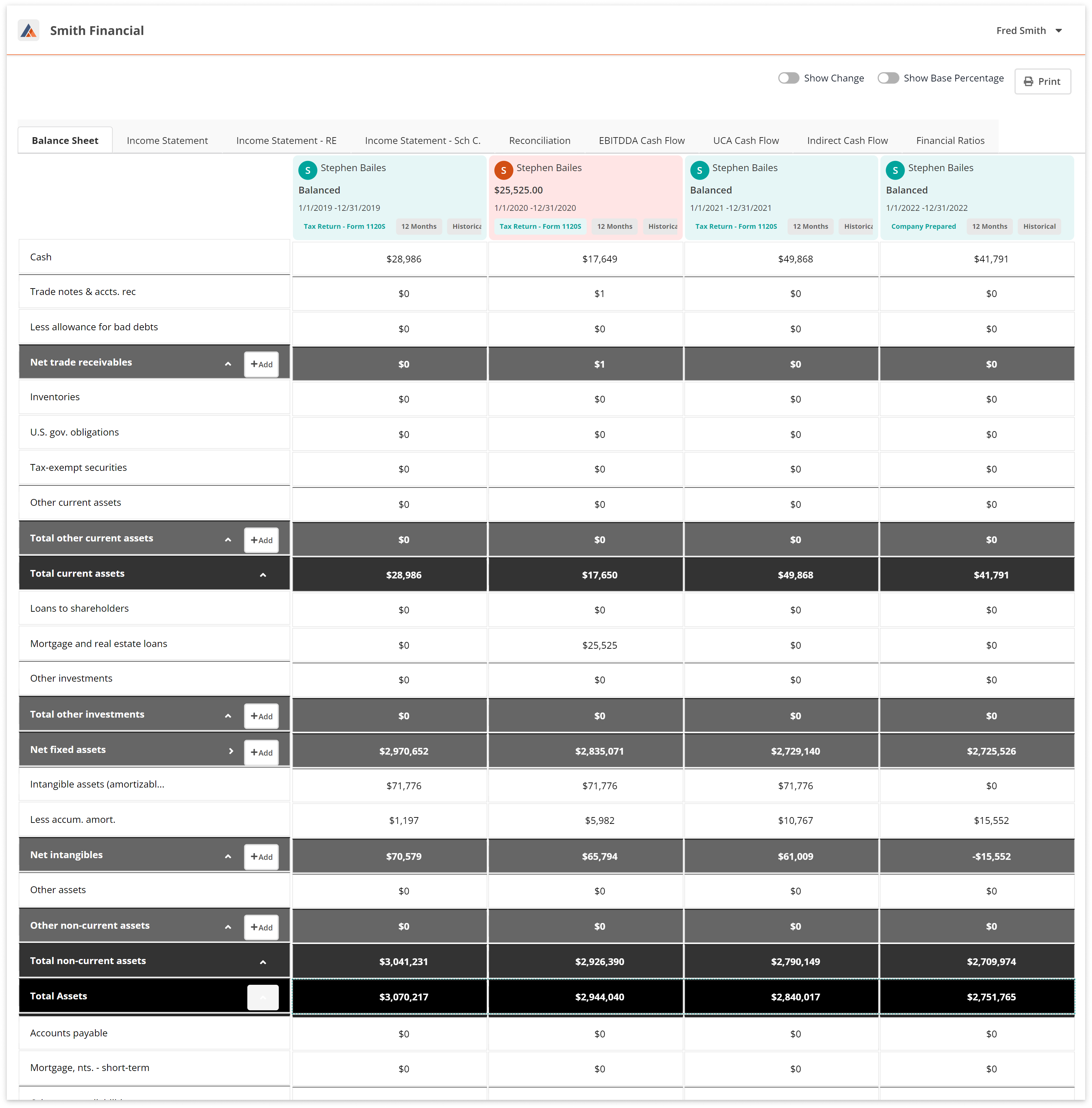

Financial Spreads Modeling

BLAST® provides institutions with the ability to create customized financial spreading models that provide a template for entering data and can include formulas for calculations. Spreads modeling helps create an efficient and effective financial spreading process.

Features include: Auto-Spreads, custom financial statement models, custom financial analysis templates, and industry-specific modeling

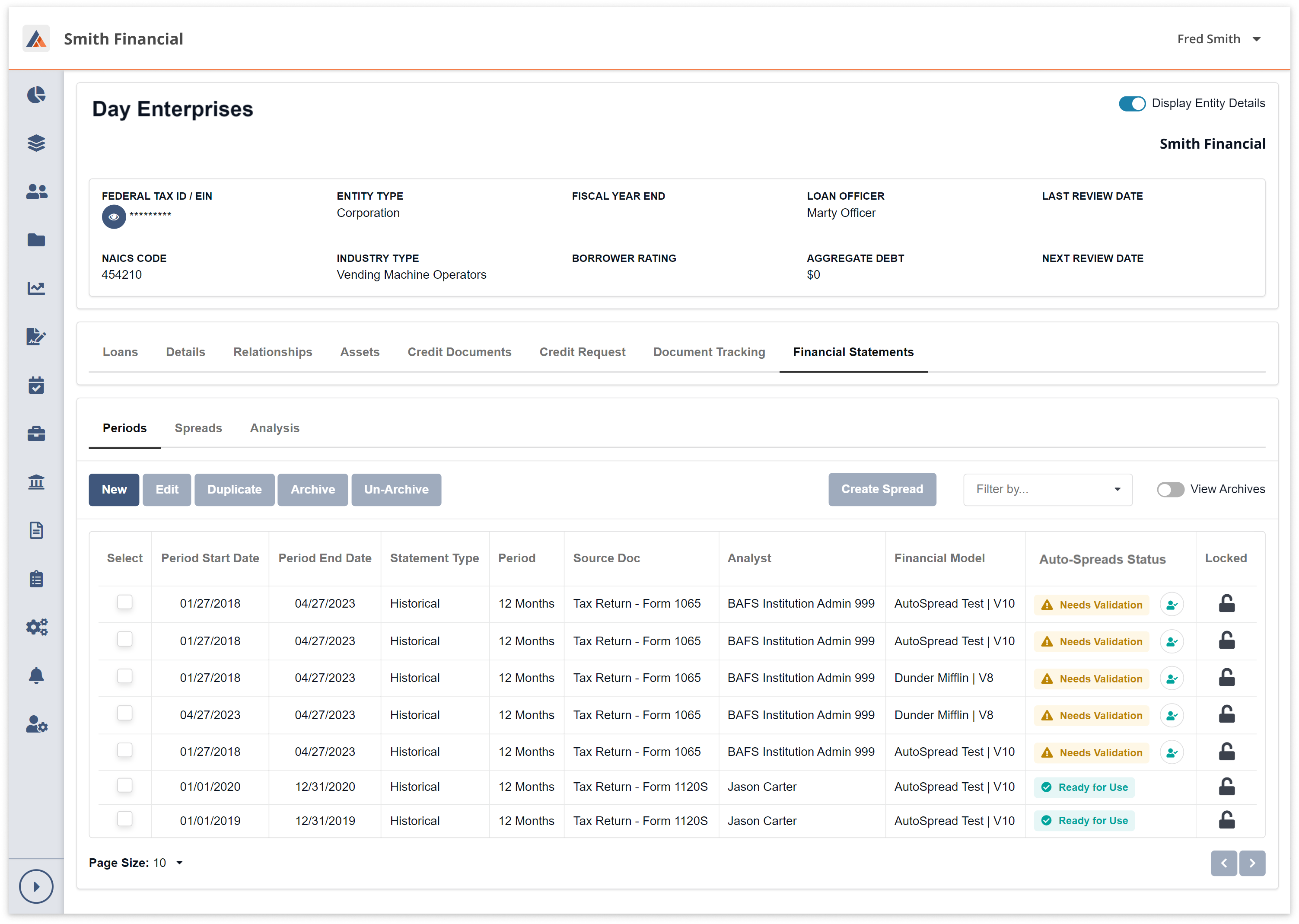

Auto-Spreads

The Auto-Spreads feature converts PDF tax forms into a format that can be applied to the spread model in just a few minutes. Once the data is scanned, it is cross-checked and any out-of-balance errors are highlighted. Once validated, the data is extracted and saved to be used to autofill the spread.

Features include: Optical character recognition (OCR), scanning to highlight errors, data extraction, and spreads autofill

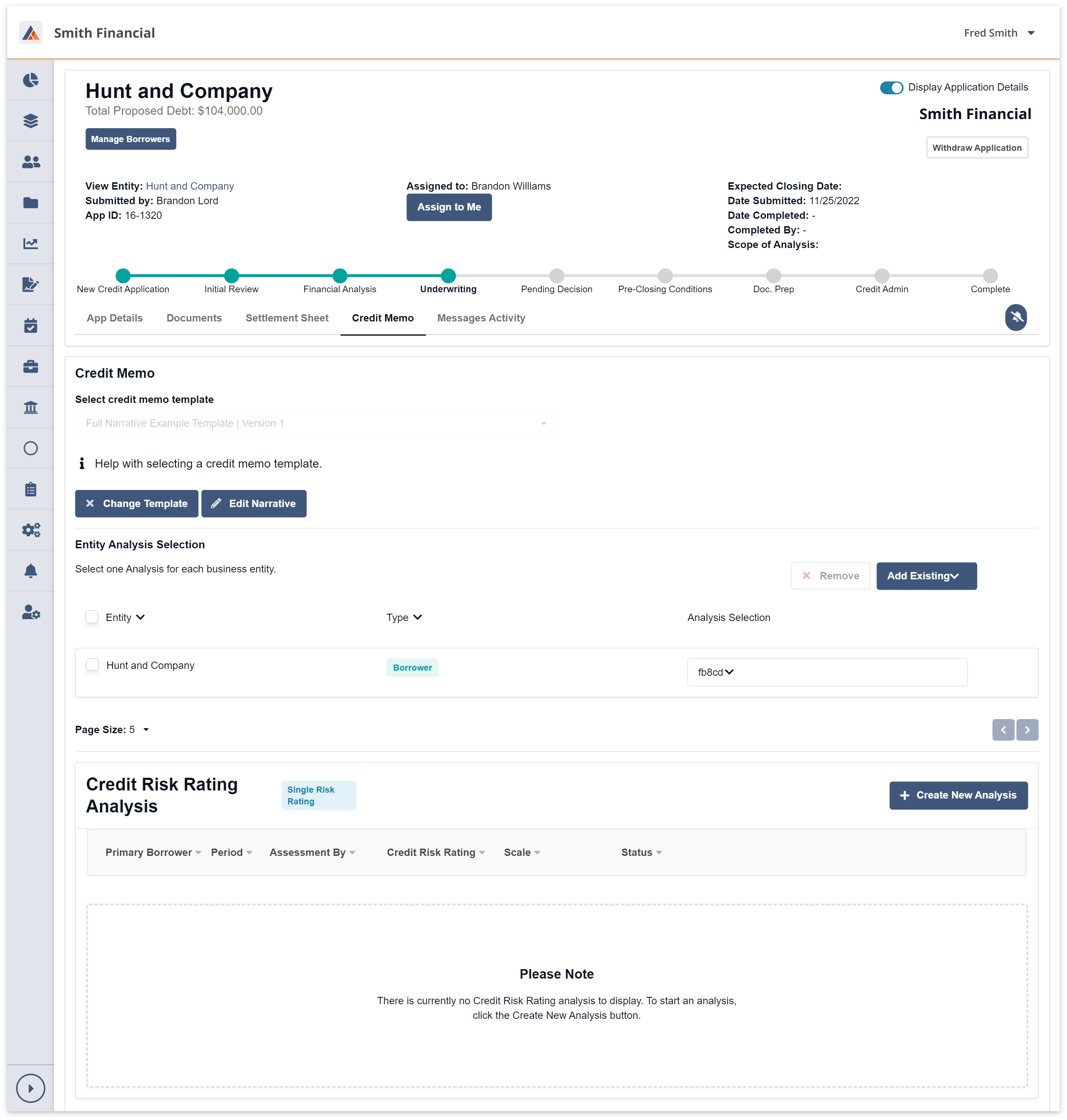

Credit Memo Modeling

A credit memorandum (credit memo) helps tell the story of a borrower, their business, and how the loan will be used. Credit memos are often unique for the type of loan, such as conventional vs SBA. A credit memo created in BLAST is a combination of a credit narrative and financial analyses.

Features include: Custom memo templates, industry-specific templates, and the ability to auto-populate application information

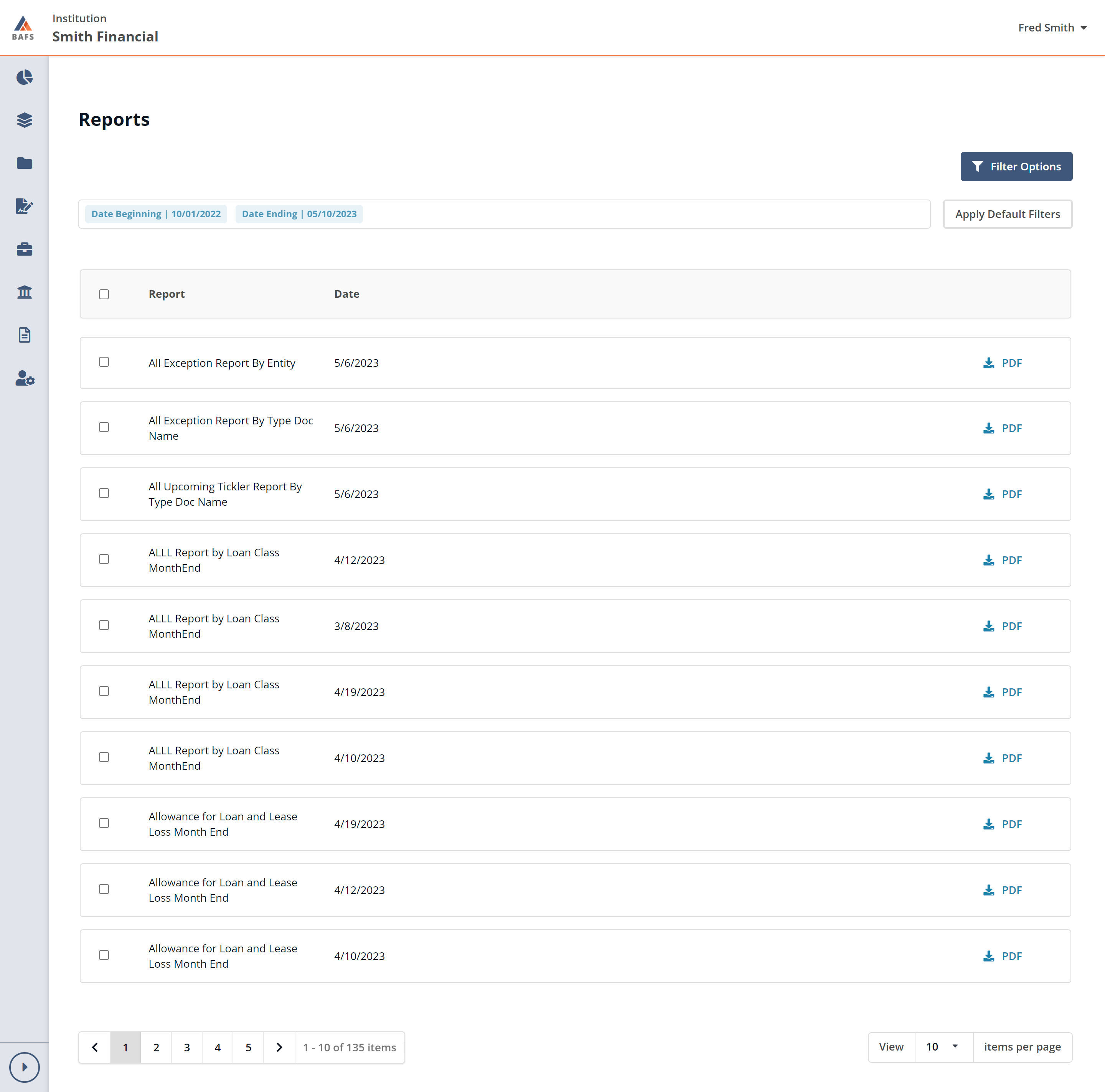

User Dashboards

This first view in BLAST® presents compelling data stories using visually rich charts and graphs. Many of the charts and graphs have tooltips that appear with data details when hovering over the chart or graph.

Features include: Historical portfolio balance, upcoming loan reviews, loan origination pipeline, loan maturing, and more

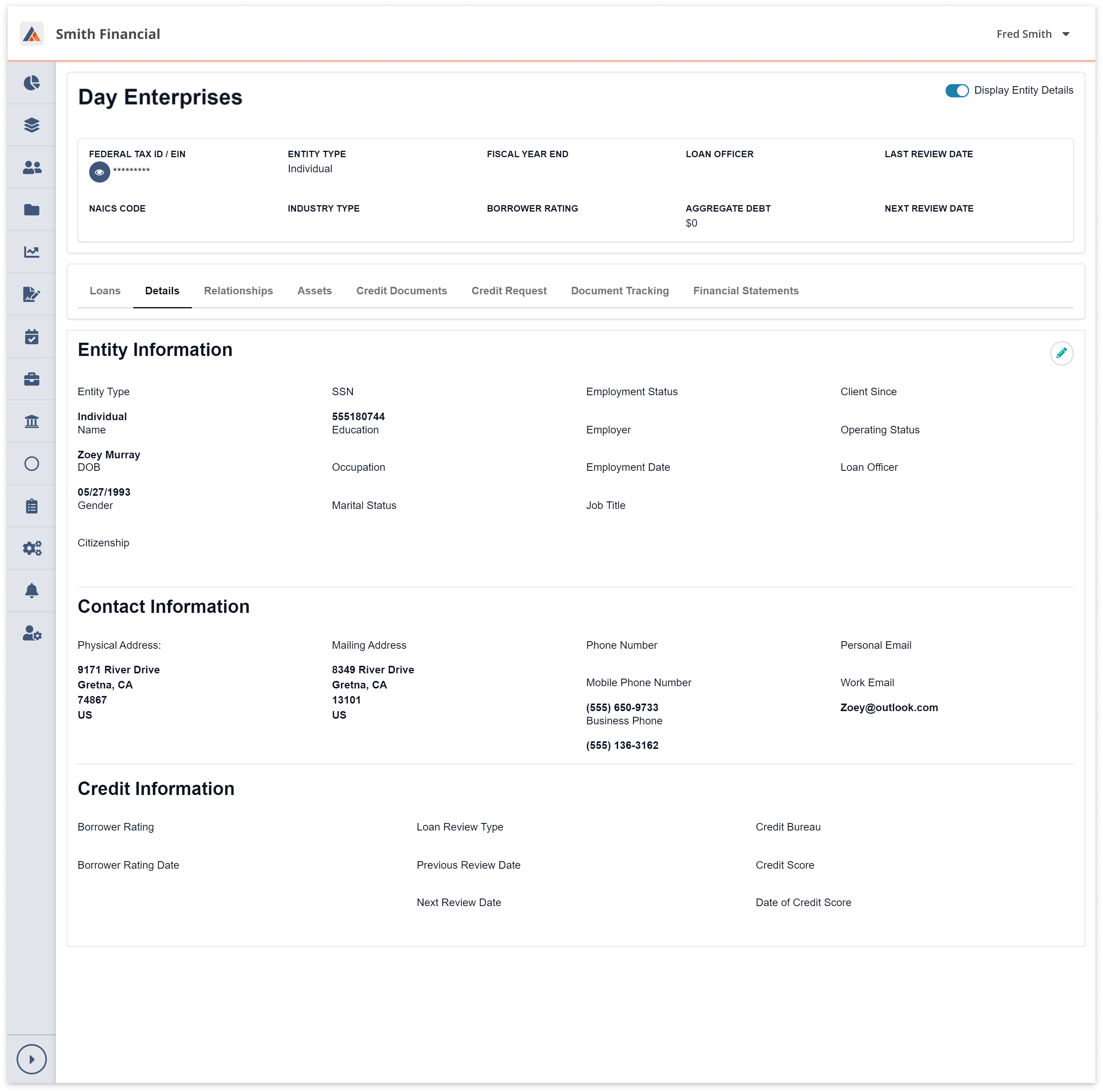

Entity Management

Capture and build out all client information up-front for a smoother loan application process. From basic entity information, relationships, and assets to credit documents and credit requests, managing entity information is all done in one place within BLAST®.

Features include: Quick access to new loan applications, quick access to existing relationships, and the ability to manage relationship documentation

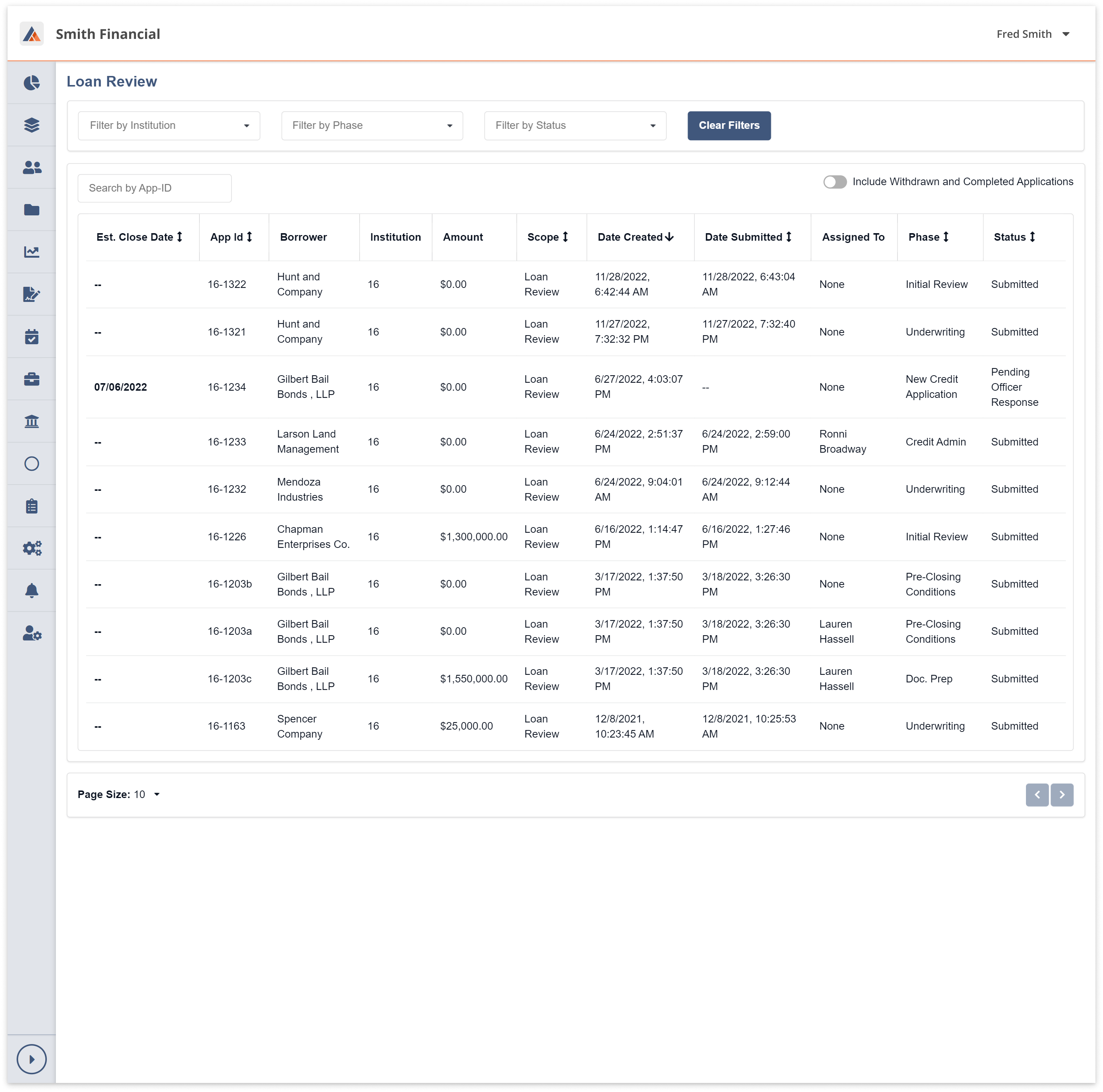

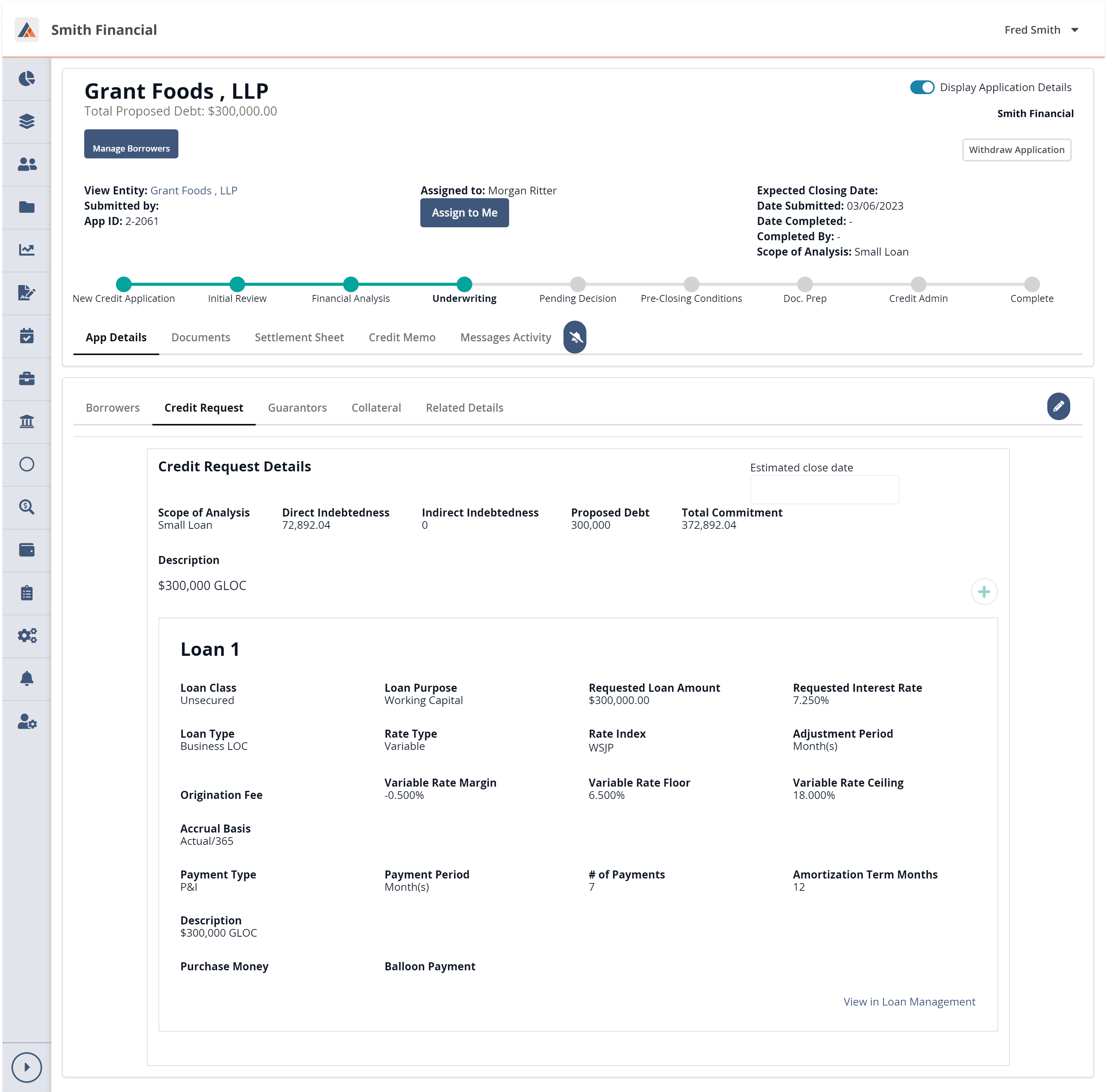

Full LOS Workflow

BLAST® provides a full workflow for all aspects of commercial lending, from application, to underwriting, document prep, and closing.

Features include: Full pipeline management, electronic application process via the BLAST® Borrower Portal, application tracking, and an internal messaging feature

View BLAST® in Action

Our BLAST®-enabled suite of services offers a comprehensive solution for loan management and credit administration across application, analysis, underwriting, and document preparation. Schedule a demo with our team and see how our coordination of people and platform will grow your business!